How COVID-19 is impacting SaverLife members

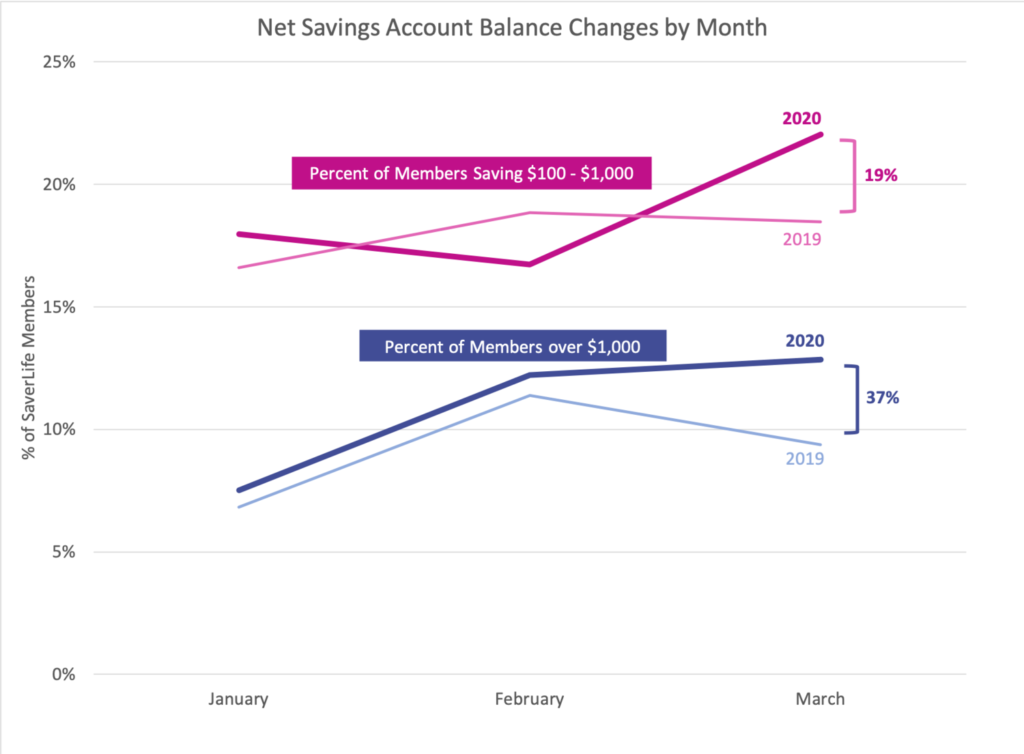

Spending is down, saving is up

As the nation continues to shelter in place, it comes as no surprise that spending on “fun” items and activities has decreased. This includes gym memberships, going to the movies, and eating out.

In order to make sure they have enough cash on hand to weather the storm, SaverLife members are even cutting back on paying down their existing debt.

In years past, March has typically been the month that healthcare spending picks up. People finally have their tax refund and they’re able to pay for medical expenses that they may have been putting off.

Healthcare spending looks a bit different this year. This could be because people are concerned about the risks of seeking medical care. It could also be because they want to save money, even at the expense of putting off treatment.

If you’re worried about paying your bills, check out some resources that may be helpful.

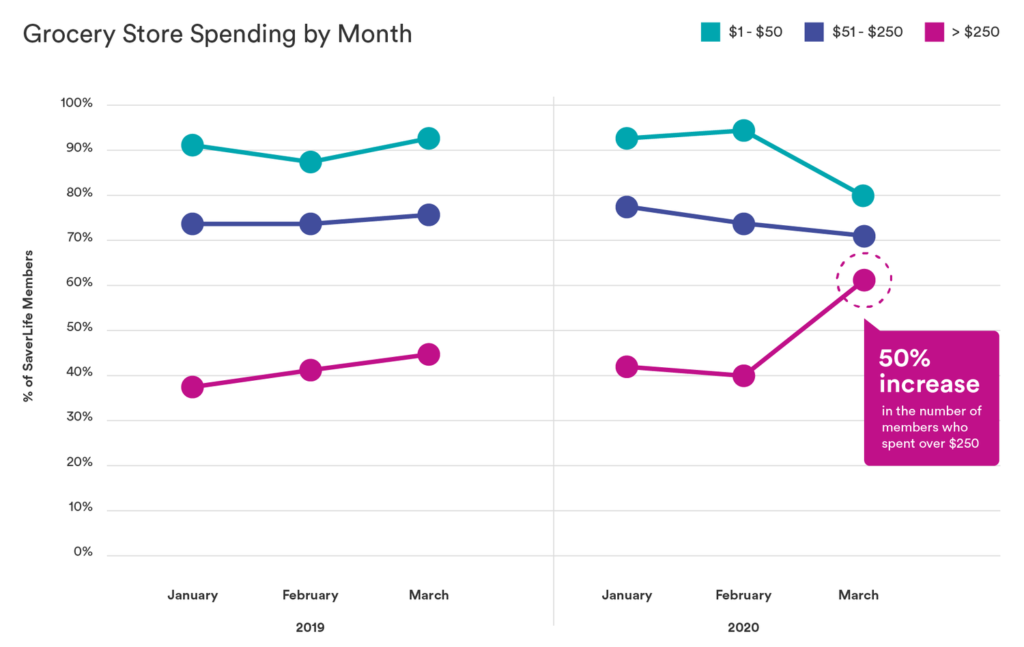

Grocery spending is up

While spending has decreased overall, that’s not the case for groceries. Compared to a few months ago or even this same time last year, grocery spending has noticeably increased.

SNAP benefits aren’t enough to cover basic needs now that kids may be missing out on school meals. Families with kids may be struggling to fill that gap.

As people try to limit their exposure to coronavirus, they’re taking fewer trips to the grocery store. But at the same time, they’re stocking up on essentials and nonperishables.

Here are our tips for grocery shopping on a budget during COVID-19.

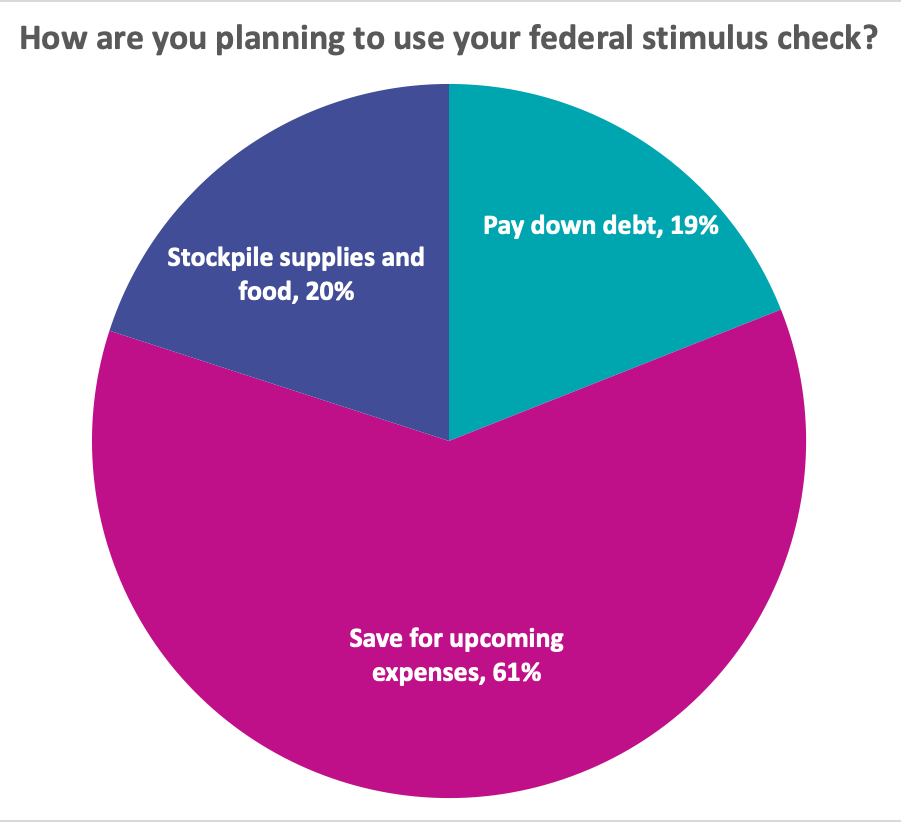

Saving for future expenses

As people brace for the economic impact of COVID-19, they are saving as much money as they can to support their families during these uncertain times. Most SaverLife members say they’re planning to use the stimulus check to save for upcoming expenses.

Wondering what the requirements are to receive a stimulus check? SaverLife CFP Tania Brown has you covered.

Learn more about how SaverLife uses research to support our members.