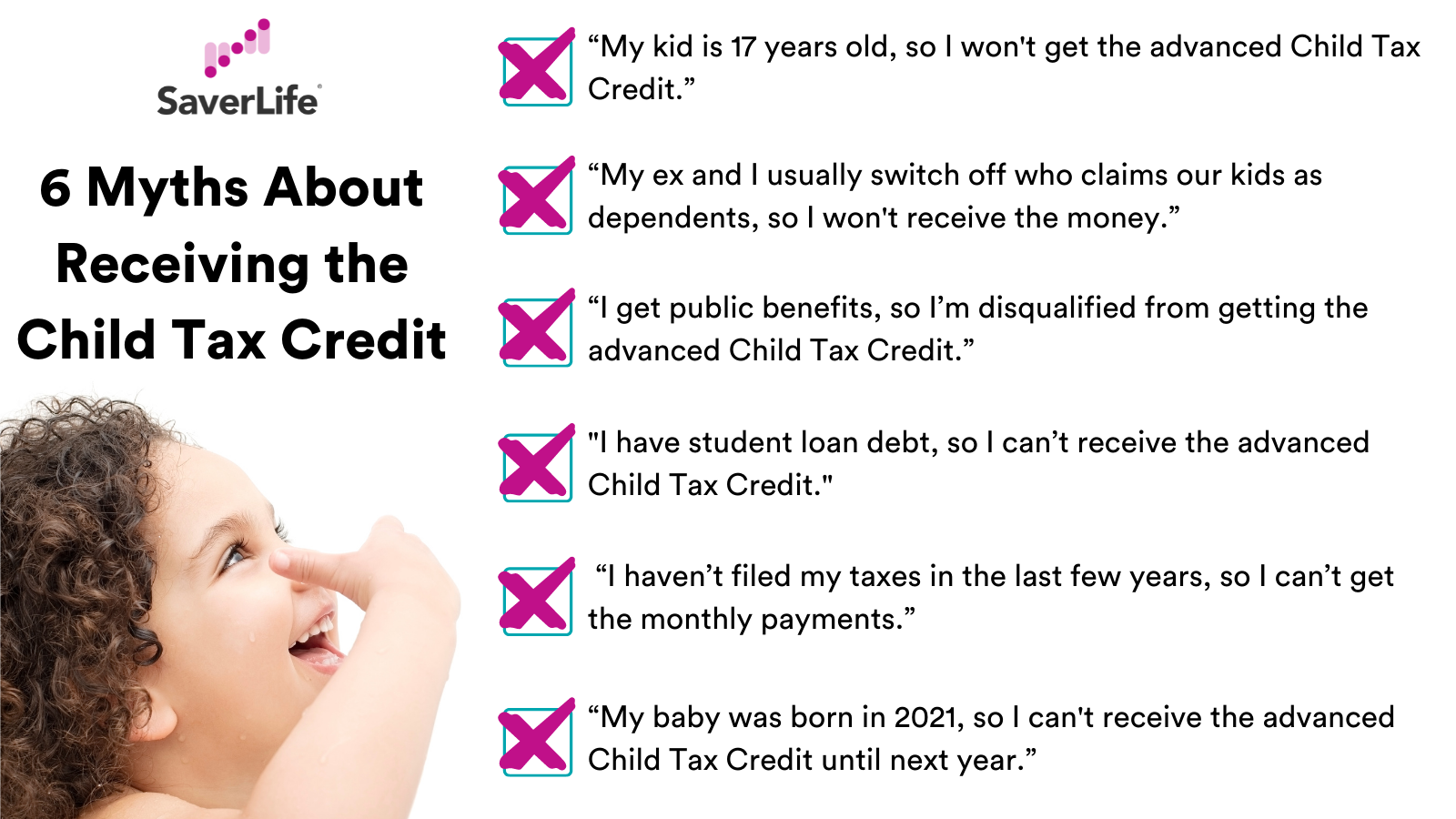

6 Myths About Receiving the Child Tax Credit

Stop! Don’t know where to start when it comes to claiming the Child Tax Credit? Take our short quiz to find out.

Myth #1: “My kid is 17 years old, so I won’t get the advanced Child Tax Credit.”

Yes, you can! This was a significant change that was included in the American Rescue Plan. As long as your child doesn’t turn 18 years old before December 31, 2021, your family will be eligible to receive the advance monthly payments for the rest of the year.

Tip: Check out our One-Stop Guide on the Child Tax Credit for more info on how to claim your funds.

Myth #2: “My ex and I usually switch off who claims our kids as dependents, so I won’t receive the money.”

This is tricky because it all depends on who filed taxes last. If you filed taxes last, then you’ll receive the advanced monthly payments. But if your ex-partner filed last year, then they will receive the advanced monthly payments. Have a conversation with them about how you two would like the payments to work out, and use this IRS Update Payment Portal to make any changes after that talk.

Myth #3: “I get public benefits, so I’m disqualified from getting the advanced Child Tax Credit.”

Incorrect! The federal government wanted to make sure that as many families as possible could receive these payments. If you receive public benefits, such as SNAP, you can still receive the advanced monthly Child Tax Credit payments. Read our 2-minute article for more information.

Myth #4: “I have student loan debt, so I can’t receive the advanced Child Tax Credit.”

This is somewhat untrue. The advanced monthly Child Tax Credit payments (see schedule here) will not be garnished. However, when you file taxes next year, the other half of the Child Tax Credit that you’ll get as a lump sum refund may be seized to repay federal student loans — if you are in default.

Tip: If you defaulted on your student loans, click here to learn more about your repayment options.

Myth #5: “I haven’t filed my taxes in the last few years, so I can’t get the monthly payments.”

If you DID fill out the IRS Non-filer form to claim any of the last year’s stimulus checks, you should automatically receive the advanced monthly Child Tax Credit payments. However you received the stimulus checks last year, by check or direct deposit, that’s how you’ll get the Child Tax Credit payments.

If you DIDN’T fill out the IRS Non-filer form to claim any of the stimulus checks in the last year, use this IRS Non-filer tool to claim the advanced monthly Child Tax Credit payments.

Myth #6: “My baby was born in 2021, so I can’t receive the advanced Child Tax Credit until next year.”

FALSE: If you have had a baby in 2021, congratulations! You could claim up to $3,600 through the advance Child Tax Credit.

BONUS

Join our exclusive, private Facebook group to learn more about our advocacy efforts and get involved. It takes a community to make a difference, so invite three friends to join once you’ve been approved to join the group. Are you in?