Can I get a stimulus check without filing taxes?

The U.S. government has just started disbursing the stimulus checks it promised to millions of Americans. Questions still linger for many, including whether they need to submit new information in order to get that money.

Will I get stimulus if I haven’t filed 2019 yet?

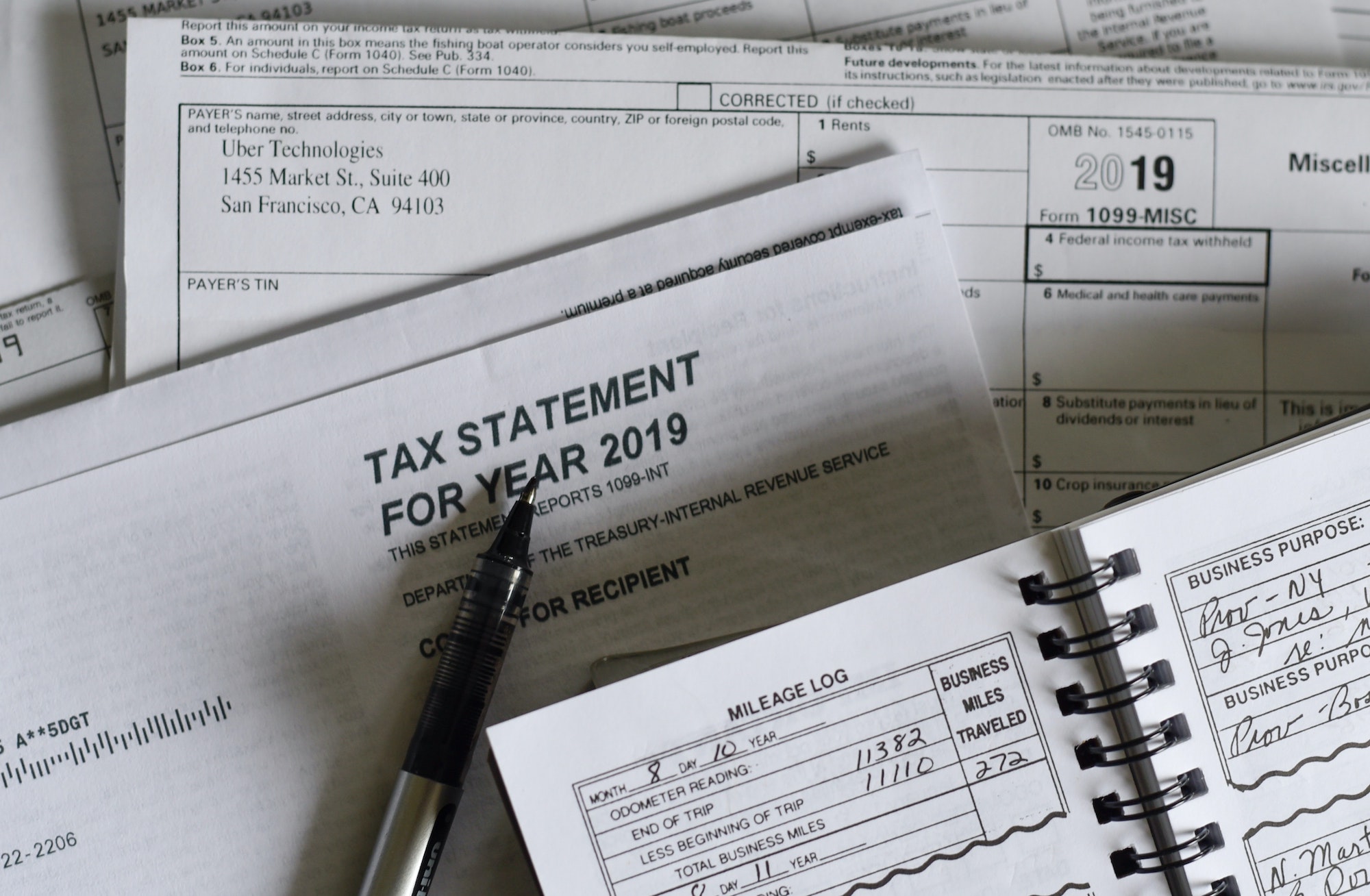

The government will calculate the amount of money you receive based on your adjusted gross income on your 2019 tax return. If the question: “I haven’t filed 2019 taxes will I get a stimulus” has been plaguing you, then you’ll be glad to know that the answer is a “yes”. If you haven’t turned in your 2019 tax return yet, it will be based on your 2018 return. However, some people may not have filed a return for either of those years. Meanwhile, others who have low income may have never filed.

How do I get my stimulus check without filing taxes?

So, how to get stimulus if you didn’t file taxes? The IRS and Treasury Department clarified this week that Social Security beneficiaries will not have to file a tax return in order to get their payments. That is because those people typically receive a 1099 form the government will use instead.

According to the latest information from the IRS, non-filers should use the Enter Payment Info tool. This tool allows you to provide the government with your preferred payment method.