Say this, save money: negotiating rent with confidence

With prices climbing across the board – from groceries to gas to car payments – rent increases can feel like the final straw. Here’s the good news: if you’re a responsible tenant with a solid rental history, you may have more negotiating power than you think. Let’s walk through how to ask for a rent…

Read MoreResources for Federal Workers

Losing a job is one of the most difficult things a person can go through. It brings stress about the future and financial uncertainty. Unfortunately, this is a very real problem for many in our country right now, especially if you are a federal worker. If you are a federal worker facing job loss, you’re…

Read MoreTalking About the Tough Stuff: A Gentle Script for Talking to Family About Future Planning

Why These Conversations Matter Discussing future plans—like wills, medical wishes, and finances—can be incredibly emotional. It’s hard to picture a time when our loved ones might not be with us, and these topics are deeply personal, often tangled with fear, love, and uncertainty. But these conversations are one of the greatest gifts you can offer…

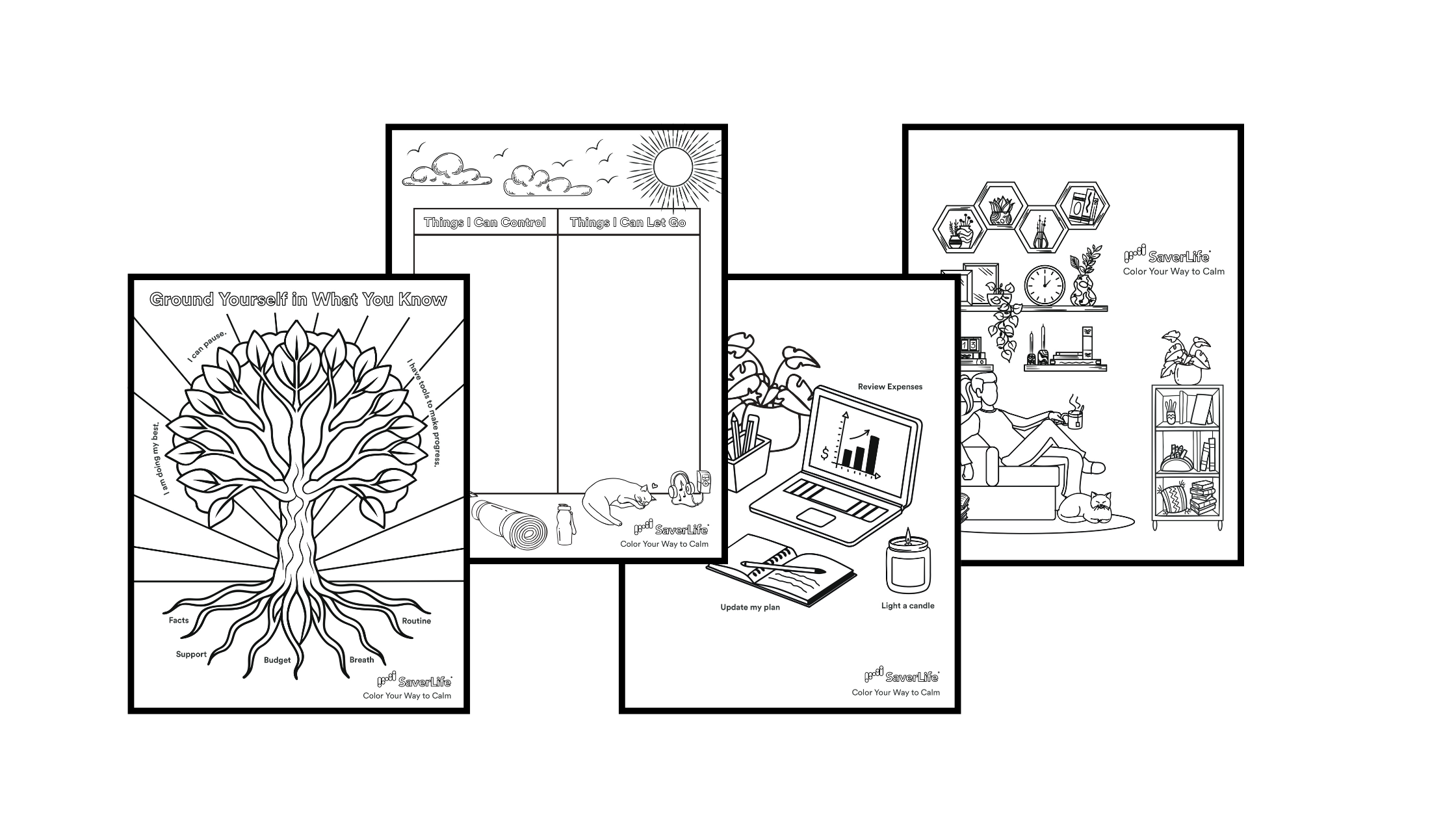

Read MoreColor Your Way to Calm: A Mindful Break with a Money Twist

Back by popular demand, our money-themed calming coloring pages are here to help you unwind and reset. Right now, many of us are feeling the weight of unpredictability—whether it’s financial stress, family responsibilities, or just the day-to-day unknowns. That’s why taking a moment to pause, breathe, and refocus is more important than ever. Studies have…

Read MoreVideo: AI-Powered Side Hustles — Can AI Help You Make Extra Cash?

With new AI tools making headlines, you might be wondering: Can this really help me earn more? Whether you’re juggling bills, looking for a side hustle to bridge an employment gap, or saving for something important, this video breaks down how AI can be impactful in the world of side hustles. We’ll look at what’s…

Read MoreHow to Prepare for a Recession: Financial Moves You Can Make Today

When the economy starts to wobble, it’s normal to feel overwhelmed. News about job losses, rising prices, or market volatility can make the future seem unpredictable. But preparing for a recession isn’t about giving in to fear — it’s about taking back your sense of control. With a few simple steps, you can build the…

Read MoreAI for Meal Planning: How Smart Tools Can Cut Your Grocery Bill

Grocery bills have gone up, even for basics like eggs and milk. It’s not just you — food inflation is impacting families across the country. Gratefully, there are a few tools that can help you make the most of your grocery dollars. AI is a free, low-effort tool that can help with meal planning and…

Read MoreMoney Prompts: How to Use AI to Save Money

AI tools are popping up everywhere these days, and while some people enjoy playing around with them, many of us are still wondering how this actually helps in real life. If you’re focused on making ends meet, paying down debt, or just trying to get through the week, using artificial intelligence (AI) might not feel…

Read MoreAI Explained: How It’s Changing Work, Money & Daily Life

What Is AI? Let’s be honest—artificial intelligence, or AI, sounds like something out of a sci-fi series. But in reality, AI is already part of your daily life, often in ways you don’t notice. At its core, AI is a set of computer programs designed to carry out tasks that usually require human thinking. These…

Read MoreHow Finances Impact Your Physical Health (And What You Can Do About It)

The Money-Health Connection Your finances affect everything in your life, from where you live to the clothes you choose. Going through tough times financially can even affect your health. The impact of financial stress can cause significant changes in your physical well-being. Knowing financial stress affects your health can feel scary. The good news is…

Read More