What Are Tax Brackets & How Do They Affect Your Money?

What are tax brackets and how do they affect you?

Are you curious how the IRS determines the amount of money you have to pay in income tax? Do you worry your recent raise or boost in self-employment income could leave you owing more taxes than it’s worth?

Today we’re going to remove the mystery around tax brackets, and put you on the path to tax pro with a quick and easy tax bracket breakdown.

Tax bracket background

Our federal income tax system is a progressive tax system. It’s usually ranked as one of the most progressive tax systems in the world.

So what does that mean?

It’s simple. Having a progressive tax system means the higher your income, the higher the tax rate you pay.

The tax code increases individual taxpayer rates as their income goes up through the use of tax brackets. There can be a complex interaction between tax brackets, deductions, and credits to determine your tax liability for the year. Today we’ll just stick to the fundamentals of tax brackets.

Common Question: If my salary increases and bumps me into a higher tax bracket, could I actually make less money after taxes?

Often I’ll run into people who say they don’t want to make more money because they’ll go up a tax bracket and pay more taxes.

My response is often, if you’re going to pocket more money, is it worth the effort to earn more money? We don’t have a 100% tax bracket, so you’ll always end up with more money if you earn more money.

Let’s look at how those tax brackets really work so you can decide whether or not you want to move up a tax bracket.

Tax brackets 101

There are 4 filing statuses for tax brackets:

- Single filers

- Married filing separately

- Head of Household

- Married filing jointly

Within each of those 4 filing statuses, there are 7 tax brackets – 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The more income you have, the higher your level will be. However, being in a certain tax bracket doesn’t necessarily mean you pay that federal income tax on everything you make.

You can find 2022 tax brackets here and 2023 tax brackets here.

How tax brackets work

When you move up a tax bracket, that first dollar in the tax bracket is taxed at the new tax rate. All your previously earned dollars are still taxed at the rates they were before. All the dollars in the new tax bracket are taxed at the newer and higher rate.

If you move into the 22% bracket from the 12% bracket, only the amount above the 12% bracket is taxed at 22%.

The tax bracket tax rate is also referred to as the marginal tax rate. This means the next dollar you earn will be taxed at that tax rate, the marginal rate.

That marginal rate usually does not apply to all your income. If you want to know what your total tax rate is or your effective tax rate, it takes a little math.

Usually, tax software will provide your marginal tax rate and your effective tax rate. For some low-income taxpayers, the effective tax rate may be below the lowest tax bracket of 10% or may even be negative. This is because of programs that are specifically designed to help lower-income taxpayers through refundable credits, primarily the Earned Income Tax Credit and the additional Child Tax Credit.

Tax Bracket Example

Let’s look at a simple example of how to determine the marginal tax rate and effective tax rate.

In 2022, all of Rachel’s income is from a W-2 job. The income in box 1 of the W-2 is $60,000. In this case, this income is also Rachel’s gross income or the total. If Rachel had other income, it would get added together to determine total income, which on the 2022 Form 1040 is on line 9.

There can be adjustments made to lower total income to get the value for Adjusted Gross Income (AGI), which is on line 11. In this simple example, and what is quite common, total income and AGI are equal.

If we just compare the total income or the AGI to the tax brackets, it might seem that Rachel, who is single, would have $18,225 of her income taxed at 22%. But that isn’t the way the tax bracket is used.

Instead, we use the taxable income from line 15 to determine where the taxpayer sits on the tax tables. Taxable income is calculated by taking AGI and subtracting either the standard deduction or itemized deductions. (Note: self-employed and other business owners may have a Qualified Business Income deduction).

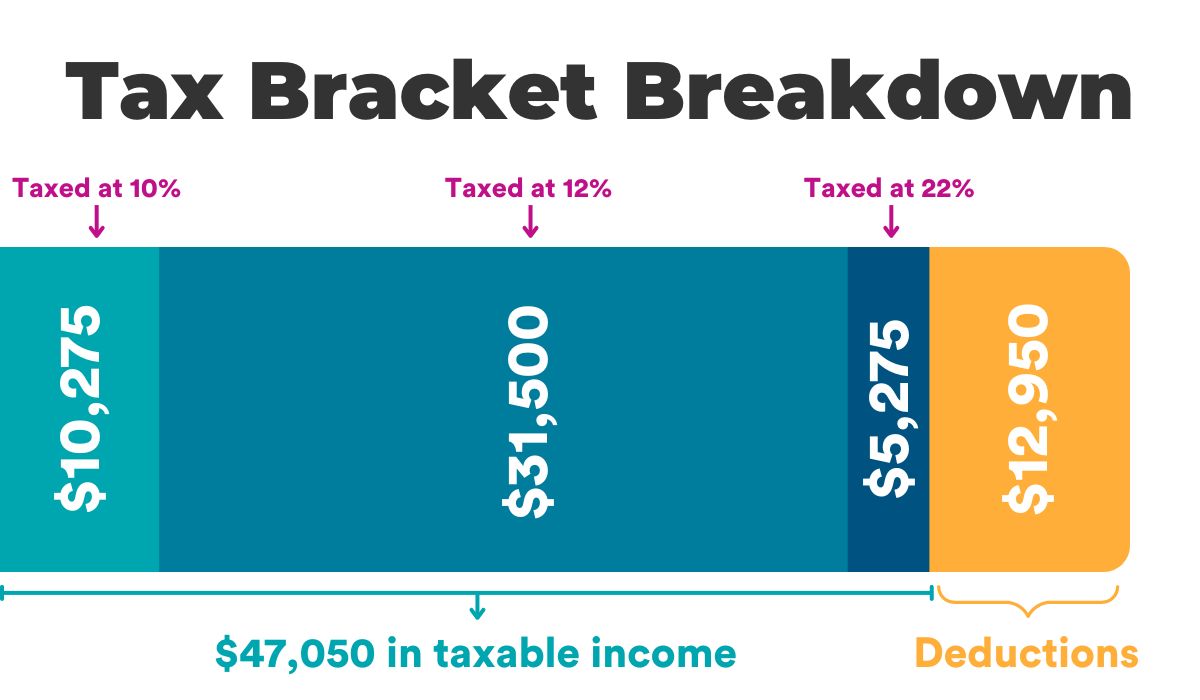

Most taxpayers take the standard deduction, so we’ll use the standard deduction for Rachel. Subtracting Rachel’s standard deduction of $12,950 means that only $5,275 is taxed at the 22% tax rate.

Let’s take a closer look at the tax rates for Rachel:

| Dollars in Tax Bracket | Income Tax Rate | Income Taxes |

| The first $10,275 | 10% tax rate | $1027.50 |

| For $10,276 through $41,775 | 12% tax rate | $3780.00 |

| For $41,776 through $47,050 | 22% tax rate | $1160.50 |

| For $47,050 through $60,000 | not taxed | |

| (standard deduction) | ||

| Total taxes for the year: | $5968 | |

| Effective tax rate: | 9.94% | |

| ($5,968/$60,000) | ||

As you can see, your tax rate does go up as your income increases, but not all of your income is taxed at the higher rate when you move up a tax bracket. And you can see that the effective tax rate, the tax rate you really are paying, is much lower than the marginal tax rate of 22%.

Note that of the $5,275 that is taxed in the 22% bracket, after the income taxes and the 7.65% you pay for social security and medicare taxes, you’ll be left with $3,711.

In my view, having that $3,711 in my bank account is usually worth the work, even though it places Rachel in the higher tax bracket. Ultimately it comes down to how much Rachel wants or needs the additional income.

How tax credits affect tax brackets

In many cases, tax credits, such as the Saver’s Credit, the Lifetime Learning Credit, and Child Tax Credit will further lower your tax liability and your effective tax rate. For example, let’s assume our example taxpayer, Rachel, is going to college and qualifies for a $2,000 credit. That changes the tax liability for the year and the effective tax rate like this:

- $5968 (from above) – $2000 = $3968 total tax liability for the year

- New effective tax rate: $3968/$60,000 = 6.6%.

As you can see, tax credits can drop the effective tax rate rather significantly.

Clearly, tax brackets matter, but it is important to remember that moving up a tax bracket doesn’t change the tax rate of the income that is below the new tax bracket.

If you want more money, earning less money due to tax bracket concerns won’t help you in most cases. Increasing income can reduce or eliminate tax credits because they often have income limits. That takes more effort to analyze, but in most cases, you will still end up with more money after taxes if you earn more money.

Jerry Zeigler is a Navy veteran who serves service members with financial counseling and education. As an Accredited Financial Counselor®, he is a member of the Better Financial Counseling Network and is the owner of JZ Financial Management. As a tax professional and Enrolled Agent, he has a passion for helping taxpayers navigate taxes.