2023 Holiday Savings Boost: Win up to $1,500 in Cash & Test Your Knowledge

The gifting season is upon us. To help you avoid seasonal stress and to prepare you mentally and financially for the festivities, we’re bringing back our Holiday Savings Boost with chances to boost your savings and test your knowledge. Our annual Holiday Savings Boost includes seasonal savings content in your SaverLife dashboard plus the Super…

Read MoreGig Workers are Actually Small Business Owners & Why That Could Mean More Money for You

We surveyed and interviewed SaverLife members who have gigs and side hustles, and one of our key takeaways is you don’t give yourself enough credit for the very meaningful work you’re doing to launch businesses. It doesn’t matter that your small business is not your primary source of income. You’re an entrepreneur, regardless. You have…

Read MoreOmar’s Story: Establishing Credit is the Foundation of Wealth

Meet Omar, a full-time college student living in San Francisco, CA with his parents and 21-year old son. What do you do? I’m studying behavioral science and addiction counseling at the City College of San Francisco. I want to be a part of the solution of dealing with all the pain that’s in the world—or…

Read MoreJanna’s Story: Freedom to Travel

Meet Janna, a licensed social worker who lives in Texas and loves to travel. What do you do? I work for 2-1-1 Texas/UnitedWay HELPLINE, doing outreach and education about 2-1-1 services. I love my work. Every day is different, and there are different topics and coalitions that the community focuses on. I actually heard about…

Read MoreMaria’s Story: $100 Saved from Every Paycheck

Meet Maria, a social worker assistant with Tribal Child Protective Services. She lives with her husband and three daughters in Phoenix, Arizona. What do you do? My husband is a construction worker and I’m a social worker assistant with Tribal CPS. I enjoy being able to work with kids and help them through problems. What…

Read MoreAndrew’s Story: The Pursuit of a Minimalist Lifestyle

Meet Andrew, a recent newlywed living in Daly City, CA with his wife and their 13-year old son. What do you do? I work for the San Francisco Public Utilities Commission in the Water Resources Department. I’ve been at this position for a little over three years, but I’ve been with the company for over…

Read MoreFelicia’s Story: Can’t Spend It If You Can’t See It

Meet Felicia*, an Administrative Assistant who lives with her boyfriend in Massachusetts. What’s your home life like? My boyfriend and I are currently renting an apartment together. It’s been really good! We both have similar working hours, and we get to sleep at the same time. What do you do? I’m currently an Administrative Assistant.…

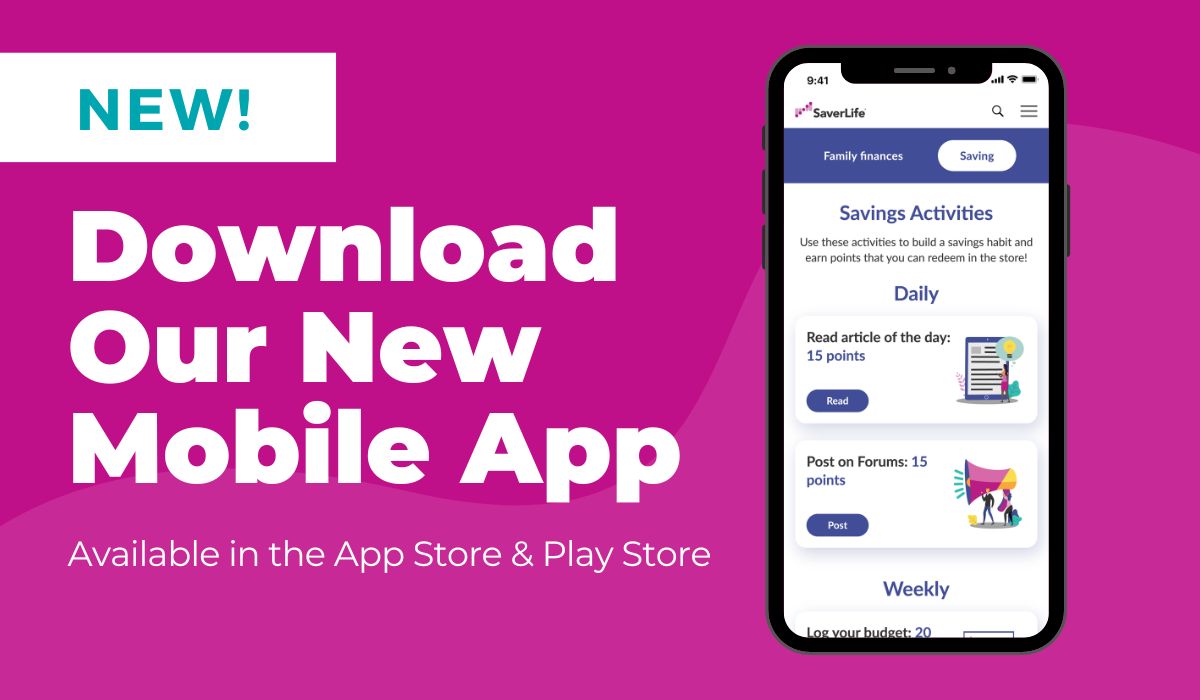

Read MoreDownload the new SaverLife Mobile App

We’re making it easier than ever to stay on track and hit your savings goals. Our brand new mobile app has all the SaverLife features you love in one convenient place. The mobile app is 100% free, just like the website. There are absolutely no fees or in-app purchases. Just download the app and create…

Read MoreTashana’s Story: Helping Foster Youth Financially Prepare for the Future

Meet Tashana, a social worker who lives with her fiancé and two kids in Virginia. Tell me about where you live and what your home is like. My family and I moved to Arlington, Virginia in December of 2017. Before that, I lived in Erie, Pennsylvania. My fiancé and I got engaged last September. We…

Read MoreBuchi’s Story: Experiences Instead of Material Items

Meet Buchi, a self-employed bookkeeper who lives and works in San Francisco. What do you do? I’m disabled and I’m self-employed with bookkeeping. I do that on the side. It’s been good for these last 9-12 years. What did your upbringing teach you about finances? (laughs) Well, to manage money responsibly. Here in the US,…

Read More