8 Common Tax Return Errors for Self-Employed Small Business Owners & Gig Workers (& How to Avoid Them)

Running your own business—or even just working for yourself—can be empowering. You get to set your own schedule, call the shots, and build something that’s yours. But let’s be honest: it can also be overwhelming. Many self-employed folks—whether you’re a business owner, freelancer, gig worker, or anyone who’s paid as a “1099 employee”—end up juggling…

Read More5 Tips for Tax Filing When You Have ACA/Marketplace Health Insurance

Are you planning to enroll in a health insurance plan sold through the Affordable Care Act Health Insurance Marketplace? Before you get started, it’s important to understand how the Premium Tax Credit (PTC) could affect your enrollment. The PTC is a refundable tax credit that can help you pay the premium for health insurance sold…

Read MoreHome Energy Tax Credits and Rebates That Can Save You Money

Did you know the IRS offers credits and rebates for improving the energy efficiency of your home? That means you could reduce the income tax you owe and maybe even qualify for a 50-100% rebate for energy-efficient improvements to your home. Residential Clean Energy Credit What expenses qualify? Expenses that may qualify include central air…

Read MoreTax Scam Alert: Disaster Relief & the Employee Retention Credit

With taxes come tax scams, and it’s important to stay informed on what these scams look like so you can protect yourself. Two of the biggest tax scams from 2023 that continue to impact taxpayers are disaster tax relief and the Employee Retention Credit (ERC), a COVID pandemic-related tax credit. Disaster Tax Relief Tax relief is…

Read More7 Helpful Hacks to Navigate a More Modern IRS & Take Advantage of Free IRS Tools & Resources

Did you know the IRS provides FREE online tools to help you file your taxes? If you’re a family with a lower income, the IRS Free File program means you may be able to file online completely free. But regardless of income, the IRS offers multiple online resources to simplify tax season and help you…

Read MorePending Tax Legislation Could Affect Your 2023 Child Tax Credit (CTC)

At SaverLife, we strive to be an ally to our members by keeping them up to date on legislation and policies that could impact their financial health. This way, SaverLife members like you have the facts necessary to make informed financial choices now and down the line. Proposed legislation called the Tax Relief for American…

Read MoreTax Credit Secrets: Tax Credits That You Didn’t Know Could Save You Money

Many taxpayers rely on tax software or tax professionals to make sure we have the best result possible for tax filing. But you could be missing out on tax credits that could reduce your tax liability and increase your tax refund. In this article, we’ll cover some tax credits you may not have heard about…

Read More6 Tax Tips for Filing Season Readiness

As tax filing season approaches, it’s a good time to make sure you’re ready to file your tax returns. This way, you can file as soon as possible. If you’re expecting a refund, this will help you get that refund as quickly as possible. However, there’s another important reason to file as soon as possible –…

Read More6 Common Tax Return Errors for Self-Employed Small Business Owners & Gig Workers

Being your own boss has advantages, but often us business owners wear a lot of hats. Even if we don’t do it ourselves, we need to know enough to make sure the people we hire are handling their tasks properly. There is a whole lot to know about taxes, and for the beginning business owner…

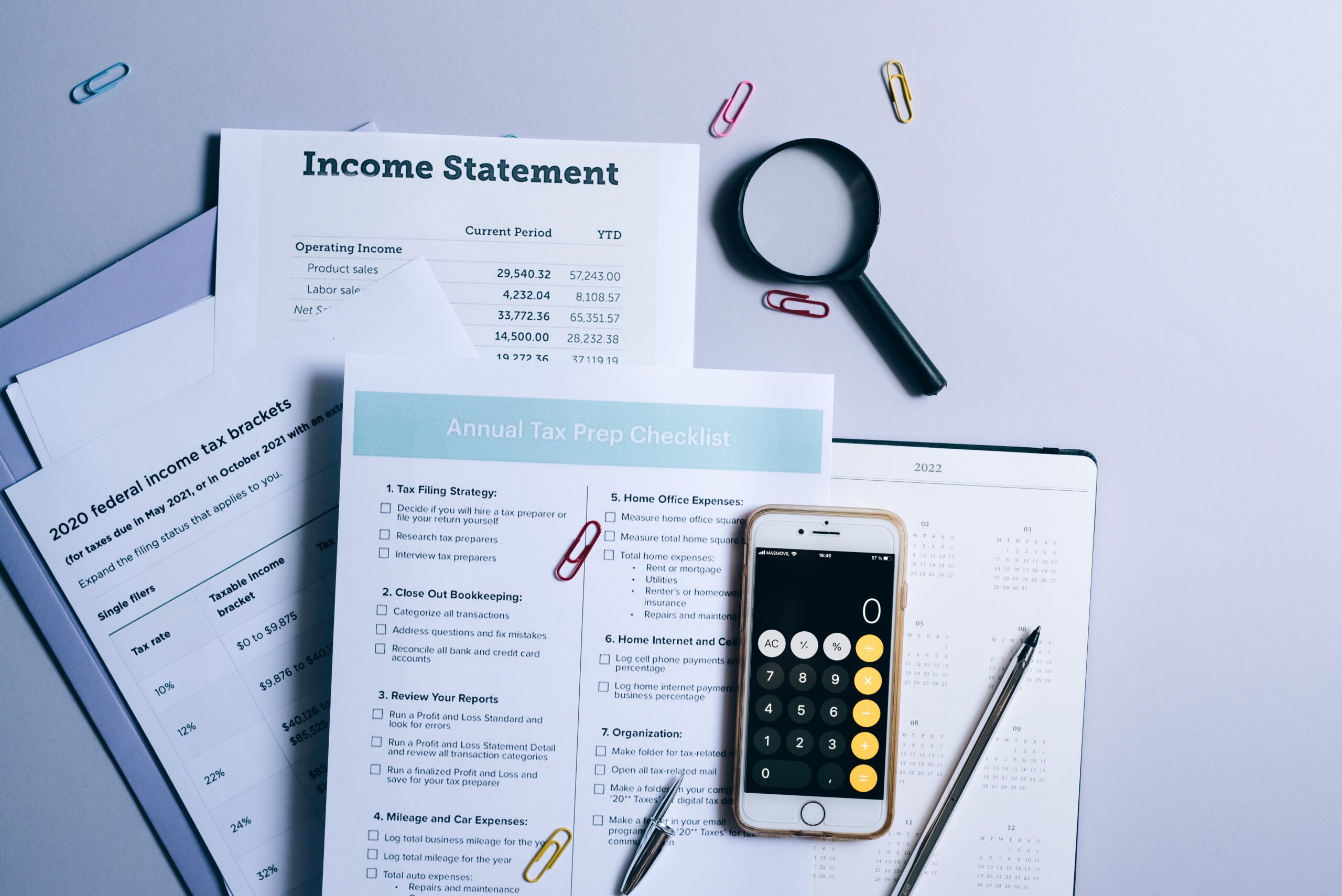

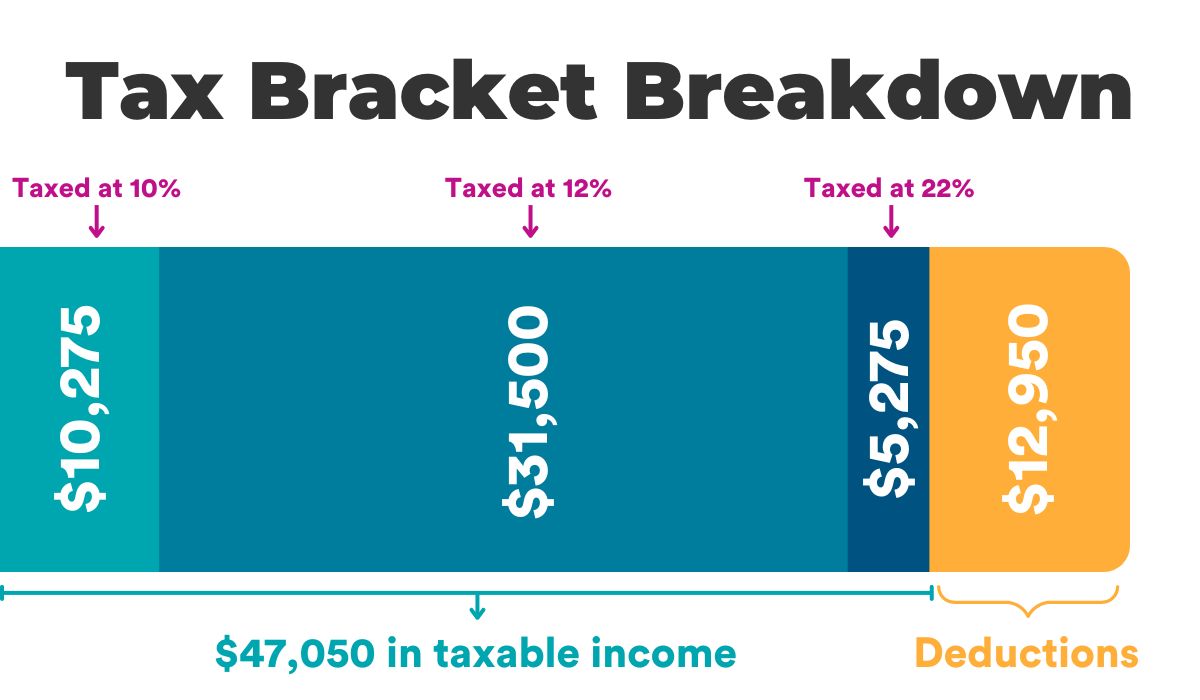

Read MoreWhat Are Tax Brackets & How Do They Affect Your Money?

Don’t miss the video breakdown in the “Tax Bracket Example” section below! ▼ What are tax brackets and how do they affect you? Are you curious how the IRS determines the amount of money you have to pay in income tax? Do you worry your recent raise or boost in self-employment income could leave you…

Read More