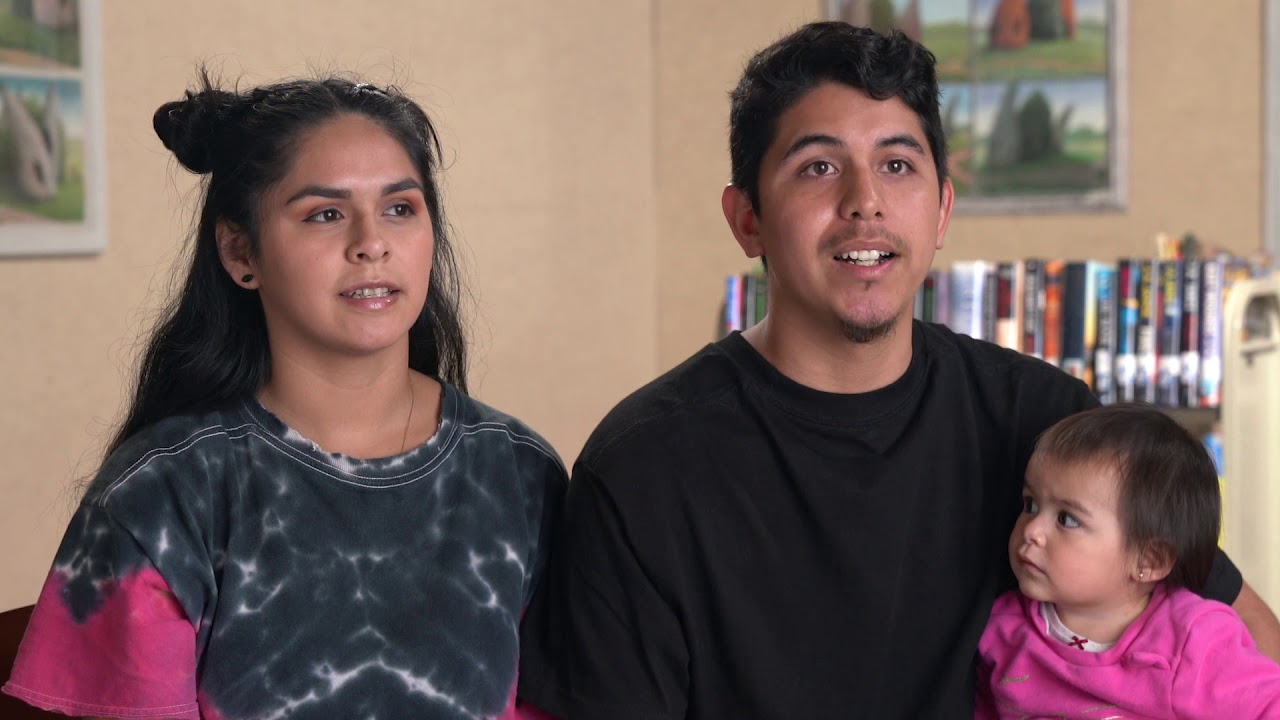

Volunteer Income Tax Assistance (VITA): A Free Way to Get Help With Your Taxes

Doing taxes can be frustrating. When every dollar counts, many of us don’t want to spend money to meet our obligations as a taxpayer. Many of us don’t want to be working in software, hoping that the right questions are asked and that you provide the right answers. This is where VITA may provide a…

Read More4 IRS Tools You Should Know About to Help You File Your Taxes

Let’s take a look at IRS.gov for some tools you may find helpful as you file your taxes! Where’s My Tax Refund? You can check your refund status on irs.gov to know whether the IRS has received your refund and is processing it. You can also read more about how to track your refund. Download…

Read MoreWho Qualifies as a Dependent: Can I Claim My Brother, Sister or Step Relative as a Dependent?

It can be confusing to figure out who you can claim as our dependent on your Federal tax return. For example, can you claim an adult as a dependent? Or, can you claim a sibling as a dependent? Or even, can you claim your girlfriend’s child on your taxes? It’s typically clear whether or not…

Read MoreHow to Track Your Tax Refund

It’s only natural to want to know the status of your tax refund. Is it being worked on? When will your refund reach your checking account? When will your refund check arrive? Many people rely on a tax professional or tax software to get this information. But you can also go straight to the IRS!…

Read MoreWhat is the Earned Income Tax Credit (EITC)? How Does Unemployment Income Impact It?

Sign up for SaverLife to take the Tax Time Pledge and enter to win cash prizes. The Federal Earned Income Tax Credit (EITC) exists to help working Americans of modest income. In 2019, 25 million taxpayers received a total of $63 billion in EITC funds. The average amount a family received was just over $2,400.…

Read MoreFour Tips for What to Do With Your Tax Refund

Many of us dread filing our taxes, yet we look forward to receiving a tax refund. Those of us with families often use those funds to provide for them. However, besides paying bills, buying necessities, and using it as fun money, I’d like you to consider using some or all of your refund to improve…

Read MoreThe 3 Most Common Tax Myths

Our Federal tax code is complicated. One thing this causes is misunderstandings of tax law. I like to call these misunderstandings “tax myths.” Like many myths, tax myths often have some truth in them. Let’s look at three common tax myths. 1. I Don’t Want to Go Up to a New Tax Bracket Sometimes people…

Read MoreWhat Is the Recovery Rebate Credit?

The COVID 19 pandemic has impacted our lives quite a bit. It has even changed our tax forms by adding a tax credit. The Recovery Rebate Credit was authorized by the CARES Act. Many of us received all or part of it in advance in the form of an Economic Impact Payment. And the Consolidated…

Read MoreYou Can Probably File Your Taxes for Free. Really.

Sign up for SaverLife to take the Tax Time Pledge and enter to win cash prizes. We know taxes are important. The government needs revenue to do things it does for our society. We want to comply with the law and pay the taxes we owe. Plus, most of us want a refund if we…

Read MoreThe Saver’s Credit: Are You Double Dipping on Tax Savings?

How Do Tax-Advantaged Accounts Work? When you contribute to a retirement account like an Individual Retirement Arrangement (IRA) or a qualified employer-sponsored retirement plan (like a 401K), you receive a tax advantage. If the account is a traditional account, you may be able to reduce your taxable income for the current year. However, you’ll pay…

Read More