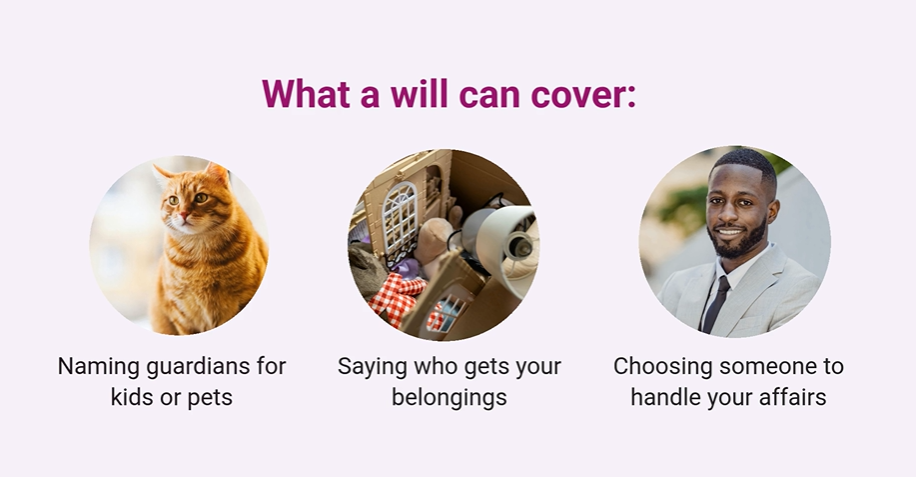

Wills for all: planning ahead isn’t just for the wealthy (video)

Planning for the future isn’t just for the wealthy; it’s for everyone. No matter your income or assets, creating a will ensures your wishes are honored and your loved ones are protected. Taking this step empowers you to leave a legacy of care and intention. You can get started easily with our SaverPerks partner, Trust…

Read MoreColor Your Way to Calm: A Mindful Break with a Money Twist

Back by popular demand, our money-themed calming coloring pages are here to help you unwind and reset. Right now, many of us are feeling the weight of unpredictability—whether it’s financial stress, family responsibilities, or just the day-to-day unknowns. That’s why taking a moment to pause, breathe, and refocus is more important than ever. Studies have…

Read MoreHow to Prepare for a Recession: Financial Moves You Can Make Today

When the economy starts to wobble, it’s normal to feel overwhelmed. News about job losses, rising prices, or market volatility can make the future seem unpredictable. But preparing for a recession isn’t about giving in to fear — it’s about taking back your sense of control. With a few simple steps, you can build the…

Read MoreRefund Round Up: Member Reflections and Expert Tips

Tax season isn’t just about paperwork — for many SaverLife members, it’s a moment of possibility. A tax refund can be a critical financial boost, offering a rare chance to catch up on bills, build a cushion, or invest in what matters most. In our latest video round-up, we spotlight how members are using their…

Read MoreMember Shareback: Coping with Uncertainty

In a recent article, we asked, “What are you doing to ease anxiety?” Your answers were honest & powerful. Many of you took the time to share your realities—the hard days, the small wins, and the strategies that help you keep going. If there’s one thing that came through loud and clear, it’s this: you…

Read MoreGetting a 1099-K? Here’s What You Need to Know

If you’re a freelancer or someone who earns income from online sales, you may have heard of the 1099-K. This form plays a crucial role in reporting income for those who receive payments through platforms like PayPal, Venmo, or credit card transactions. Understanding it can save you from tax headaches and help keep your finances…

Read MoreMember Experience: Clean Energy

With energy costs on the rise, many families are struggling to keep up with their monthly bills. Clean energy can seem like an expensive solution, but for many, it’s a way to save money in the long run. We wanted to know, what are SaverLife members experiencing? Check out our infographic below! It’s clear that…

Read MoreYou’re Not Alone: Navigating Uncertain Times Together

Right now, it feels like everything is changing faster than we can keep up—rising costs, shifting job markets, and an overall sense of uncertainty. If you’re feeling stressed or anxious, know that you’re not alone. The weight of the unknown can take a real toll on mental health, making it harder to focus, plan, or…

Read MoreVideo: Understanding Energy Tax Credits for Home Upgrades

From upgrading your appliances to improving insulation or even going solar, these home energy credits can put money back in your pocket while reducing your energy use. But how do they work, and who qualifies? In this video, we’ll break it all down—what home energy credits are, how to claim them, and how they can…

Read MoreVideo: 2025 Common Tax Scams and How to Avoid Them

Tax season is here, and while many of us are focused on filing correctly and getting our refunds, scammers are working just as hard to take advantage of taxpayers. Every year, thousands of people fall victim to tax scams—losing money, personal information, and peace of mind. In this video, we’ll break down the most common…

Read More