Beyond the Check: How the Second Stimulus Bill Will Benefit You

There has been a ton of news coverage about the second round of stimulus payments. Whether or not you’ve received a stimulus check, there’s more to the bill that could potentially benefit you. You probably don’t have time to read the 500+ pages of legislation, so we’ve done that for you. This post is a…

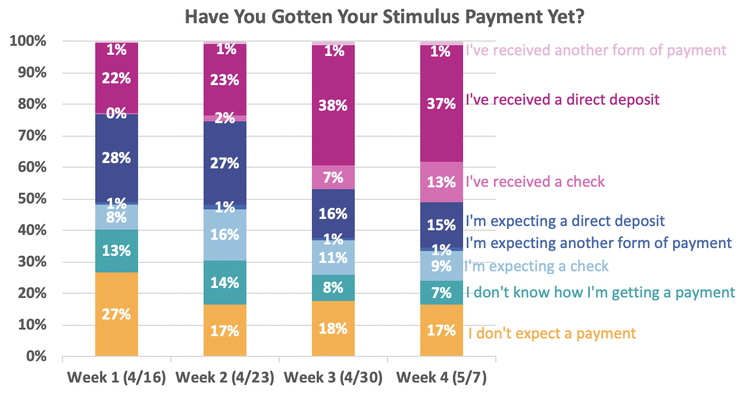

Read MoreHave You Received Your Second Stimulus Payment Yet?

If you’re like most people, the word stimulus makes you perk up your ears these days. Perhaps you’ve either already received or eagerly await that much-needed payment, which will arrive by a deposit in your bank account, a check in the mail, or an Economic Impact Payment Card. With the second stimulus bill now in…

Read MoreSecond Stimulus Eligibility: Am I Eligible for the IRS Second Stimulus Check?

Just before 2020 ended and 2021 began, President Trump signed a second pandemic relief bill. This bill included a second round of stimulus checks, or Economic Impact Payments, that will be sent to Americans under certain income thresholds in the coming weeks. Some of these checks have already started filtering in via direct deposit. As…

Read MoreWhat Is the Recovery Rebate Credit?

The COVID 19 pandemic has impacted our lives quite a bit. It has even changed our tax forms by adding a tax credit. The Recovery Rebate Credit was authorized by the CARES Act. Many of us received all or part of it in advance in the form of an Economic Impact Payment. And the Consolidated…

Read MoreHow to Re-Imagine Your Disposable Income During a Recession

The biggest threat to your finances during a recession is a reduction or loss of income. Seemingly disposable income now may be a lifeline to keep you from eviction, foreclosure, or repossession. So if you’re doing okay right now, it’s a good time to fortify your financial foundation. If anything in your financial picture changes,…

Read MoreWhat Is a Recession and How Do I Prepare for One?

The National Bureau of Economic Research (NBER) is the organization that decides if the US is in a recession. They define a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” So, what the heck does this mean? In a recession, companies are…

Read MoreYou may be eligible for the IRS’s rounds of stimulus checks

When will the stimulus checks be sent out? [Updated as of October 2020] If you typically don’t file taxes, you have until November 21st, 2020 to fill out the IRS Non-Filer form in order to be sent your stimulus check. About 12 million Americans are still eligible to receive these stimulus checks. For the past…

Read MoreShould I drain my emergency savings because of coronavirus?

First off, congratulations for having an emergency fund! Approximately 25% of Americans couldn’t cover an unexpected $400 bill, let alone a month of expenses. To answer the question of whether or not you should drain your emergency fund because of coronavirus, that all depends on your situation. Do you need to drain your emergency fund?…

Read More3 Strategies to Stretch Your Food Dollars

As the COVID-19 pandemic continues, you may have to stretch a lower income to cover regular expenses. If your income has been reduced or you have had a lot of unexpected expenses, having enough money to feed yourself and your family may be a challenge. Food is a necessity to maintain a healthy life. But…

Read MoreWhat to Do If You Need Help Paying for Prescription Medicines

If you’ve ever been in the situation where you have to decide whether to pay for your prescription or put groceries on the table, you know how scary that can be. What many people don’t know is that there are several programs that can help you pay for those prescriptions. They are called Patient Assistance…

Read More