Rideshare Rates: See how much Uber & Lyft drivers earn in your state

Curious how your rideshare earnings stack up? We crunched the numbers from SaverLife members who are rideshare drivers across the country, and now you can see the average income for Uber and Lyft drivers in different states. Whether you’re driving full-time or picking up shifts on the side, this data gives you a clear picture…

Read MorePower in Renting: What Every Renter Should Know About Their Rights

Renting your home doesn’t mean giving up your power. As a renter, you have rights that protect your safety, stability, and financial well-being. Knowing these rights can help you feel more confident when challenges come up. 1. You Have the Right to a Safe Home Your landlord must provide a safe and livable place. This…

Read MorePower in Renting: Build Credit by Reporting your Rent

For potential homeowners, your rent is the most similar (and likely the largest) monthly obligation. So here’s a question: Shouldn’t you get credit – pun fully intended – for making those on-time payments? Even if you’re not actively house hunting, your credit score plays a huge role in your financial life. A strong score can…

Read MoreSay this, save money: negotiating rent with confidence

With prices climbing across the board – from groceries to gas to car payments – rent increases can feel like the final straw. Here’s the good news: if you’re a responsible tenant with a solid rental history, you may have more negotiating power than you think. Let’s walk through how to ask for a rent…

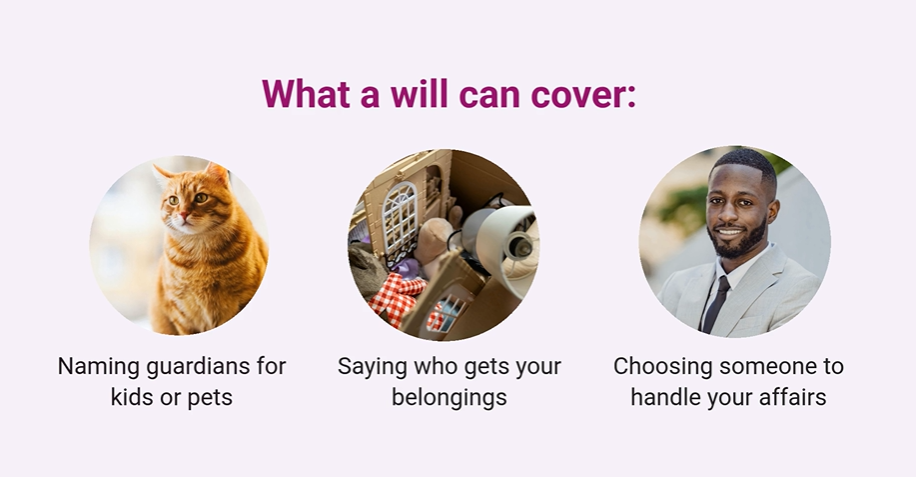

Read MoreWills for all: planning ahead isn’t just for the wealthy (video)

Planning for the future isn’t just for the wealthy; it’s for everyone. No matter your income or assets, creating a will ensures your wishes are honored and your loved ones are protected. Taking this step empowers you to leave a legacy of care and intention. You can get started easily with our SaverPerks partner, Trust…

Read MoreVideo: AI-Powered Side Hustles — Can AI Help You Make Extra Cash?

With new AI tools making headlines, you might be wondering: Can this really help me earn more? Whether you’re juggling bills, looking for a side hustle to bridge an employment gap, or saving for something important, this video breaks down how AI can be impactful in the world of side hustles. We’ll look at what’s…

Read MoreHow Finances Impact Your Physical Health (And What You Can Do About It)

The Money-Health Connection Your finances affect everything in your life, from where you live to the clothes you choose. Going through tough times financially can even affect your health. The impact of financial stress can cause significant changes in your physical well-being. Knowing financial stress affects your health can feel scary. The good news is…

Read MoreHow Voting Affects Your Future Finances

At SaverLife, we believe change begins with our members (like you!). Your story, your goals, and your unique perspective have the power to shift how the financial system supports people living on low-to-moderate incomes. That’s why SaverLife works closely with our members to unlock new insights on financial health. The feedback SaverLife members provide inspires…

Read MoreA Beginner’s Guide to Financial Health for Gen Z

Were you born between 1996 and 2012? If so, you’re most likely part of Gen Z: the generation that’s entering or well into their 20s. SaverLife wants to better understand our Gen Z members who are navigating their financial health journeys. From our preliminary research, we uncovered that young adults are spending significantly more on…

Read MoreDebt Dilemma: The Impact of Student Loans on Your Financial Future

If you have student loans, you’re not alone. According to a recent Forbes article, there are roughly 43 million people currently holding federal student loans. This translates to roughly 13% of the United States population! Plus, this number only accounts for federal student loans; it doesn’t even account for the debt owed by private loans…

Read More