Tips for Affording a New Electric Vehicle & Saving on Maintenance

Are you in the market for a new or “new to you” vehicle? If you’re debating whether to get a gas-powered vehicle or switch to an electric vehicle (EV), there are some ways you can save on both the cost of an EV and the cost to charge and maintain it. As the technology behind…

Read MorePending Tax Legislation Could Affect Your 2023 Child Tax Credit (CTC)

At SaverLife, we strive to be an ally to our members by keeping them up to date on legislation and policies that could impact their financial health. This way, SaverLife members like you have the facts necessary to make informed financial choices now and down the line. Proposed legislation called the Tax Relief for American…

Read More4 Ways Small Business Owners Benefit from the Inflation Reduction Act

Many small business owners and gig workers are still struggling in the aftermath of the pandemic. Rising inflation is increasing costs of everything from utilities to health care. The Inflation Reducation Act aims to relieve some of that pressure through expanding benefits and increasing incentives for small business owners and entrepreneurs who are just starting…

Read MoreTax Credit Secrets: Tax Credits That You Didn’t Know Could Save You Money

Many taxpayers rely on tax software or tax professionals to make sure we have the best result possible for tax filing. But you could be missing out on tax credits that could reduce your tax liability and increase your tax refund. In this article, we’ll cover some tax credits you may not have heard about…

Read MoreIRS Expansion Means Faster Tax Support & More Access to Tax Credits

Often, people aren’t excited about filing their taxes. It’s a lot of work and can be complicated. But, over the past few years, the Internal Revenue Service (IRS) has worked to make the process easier and more accessible to Americans. When President Biden’s administration passed the Inflation Reduction Act in August 2022, one of its…

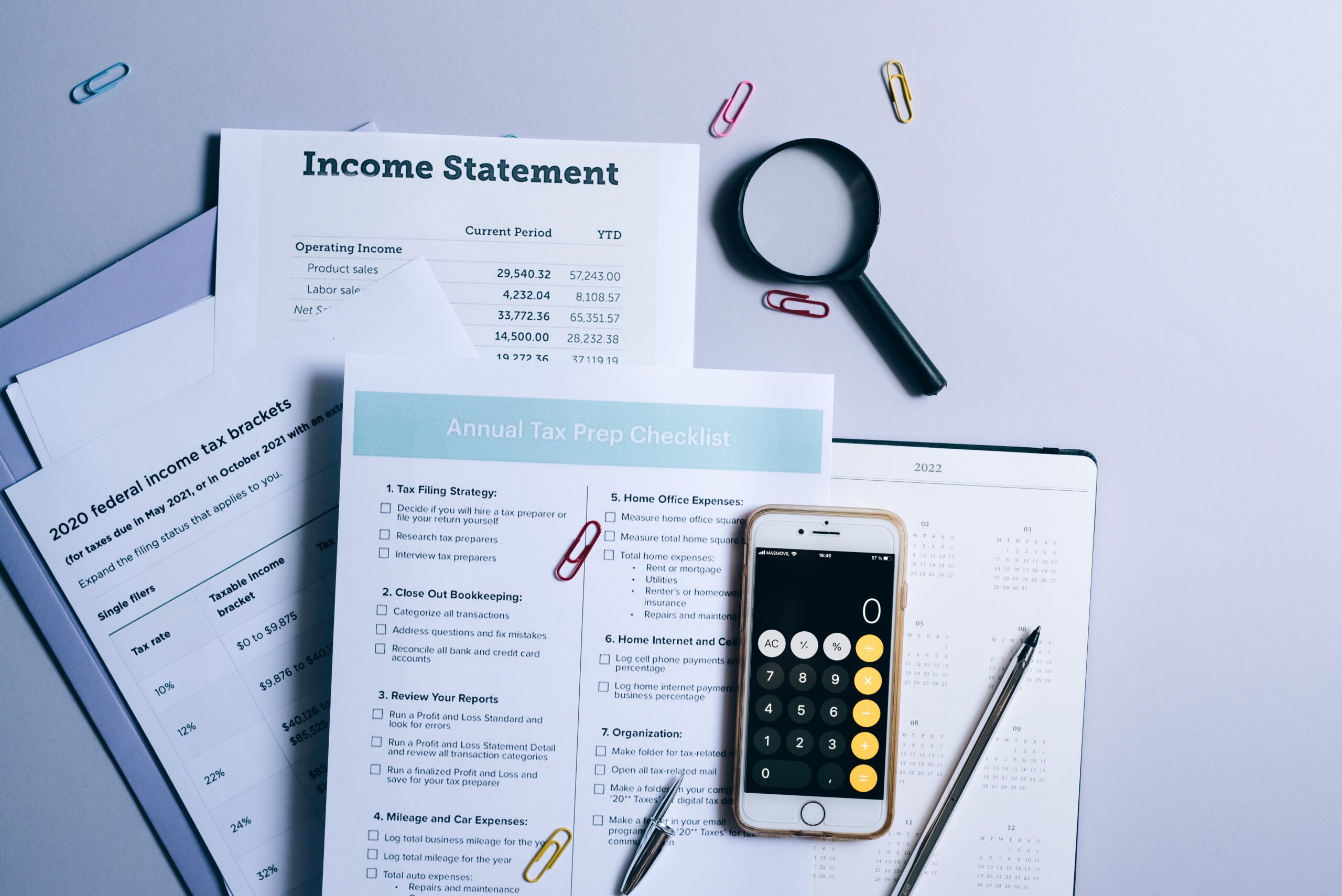

Read More6 Tax Tips for Filing Season Readiness

As tax filing season approaches, it’s a good time to make sure you’re ready to file your tax returns. This way, you can file as soon as possible. If you’re expecting a refund, this will help you get that refund as quickly as possible. However, there’s another important reason to file as soon as possible –…

Read MoreGig Workers are Actually Small Business Owners & Why That Could Mean More Money for You

We surveyed and interviewed SaverLife members who have gigs and side hustles, and one of our key takeaways is you don’t give yourself enough credit for the very meaningful work you’re doing to launch businesses. It doesn’t matter that your small business is not your primary source of income. You’re an entrepreneur, regardless. You have…

Read More6 Common Tax Return Errors for Self-Employed Small Business Owners & Gig Workers

Being your own boss has advantages, but often us business owners wear a lot of hats. Even if we don’t do it ourselves, we need to know enough to make sure the people we hire are handling their tasks properly. There is a whole lot to know about taxes, and for the beginning business owner…

Read More6 Small Business Bookkeeping Hacks You Can Start Today

If you’ve experienced a moment of panic trying to manage your new business’s finances, you’re not alone. Launching a small business is an exciting and stressful time, but bookkeeping doesn’t have to add to the pressure. Here are 6 small business bookkeeping hacks you can start today: Hack #1: Separate Your Business and Personal Finances…

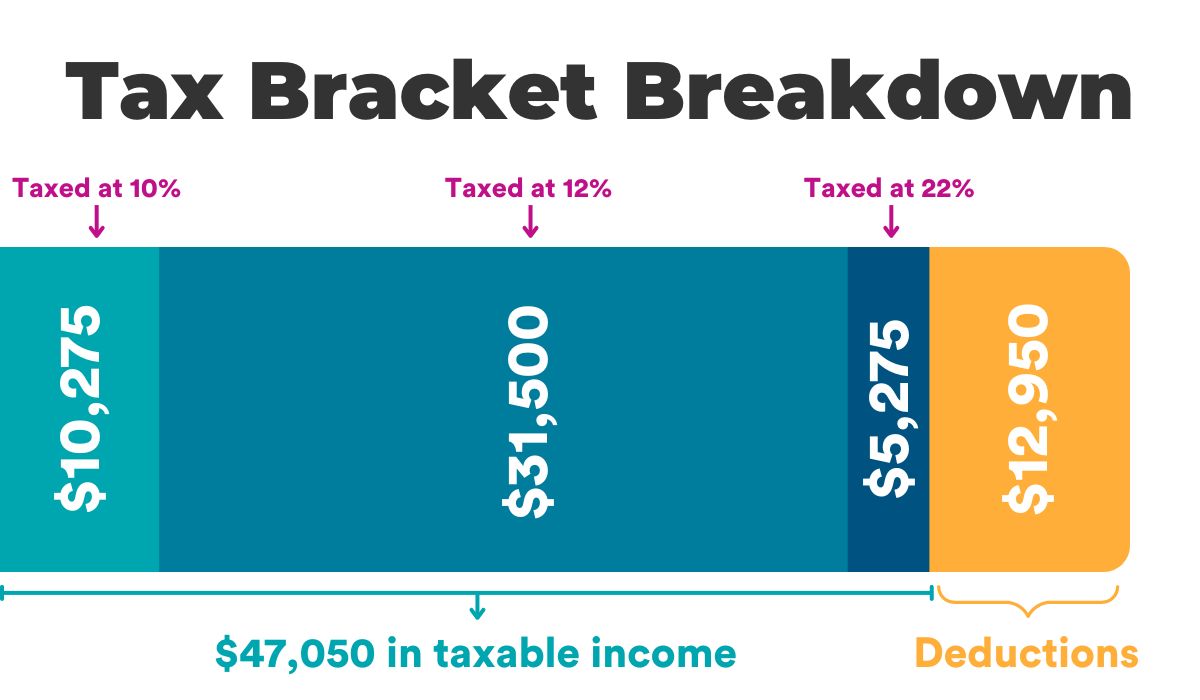

Read MoreWhat Are Tax Brackets & How Do They Affect Your Money?

Don’t miss the video breakdown in the “Tax Bracket Example” section below! ▼ What are tax brackets and how do they affect you? Are you curious how the IRS determines the amount of money you have to pay in income tax? Do you worry your recent raise or boost in self-employment income could leave you…

Read More