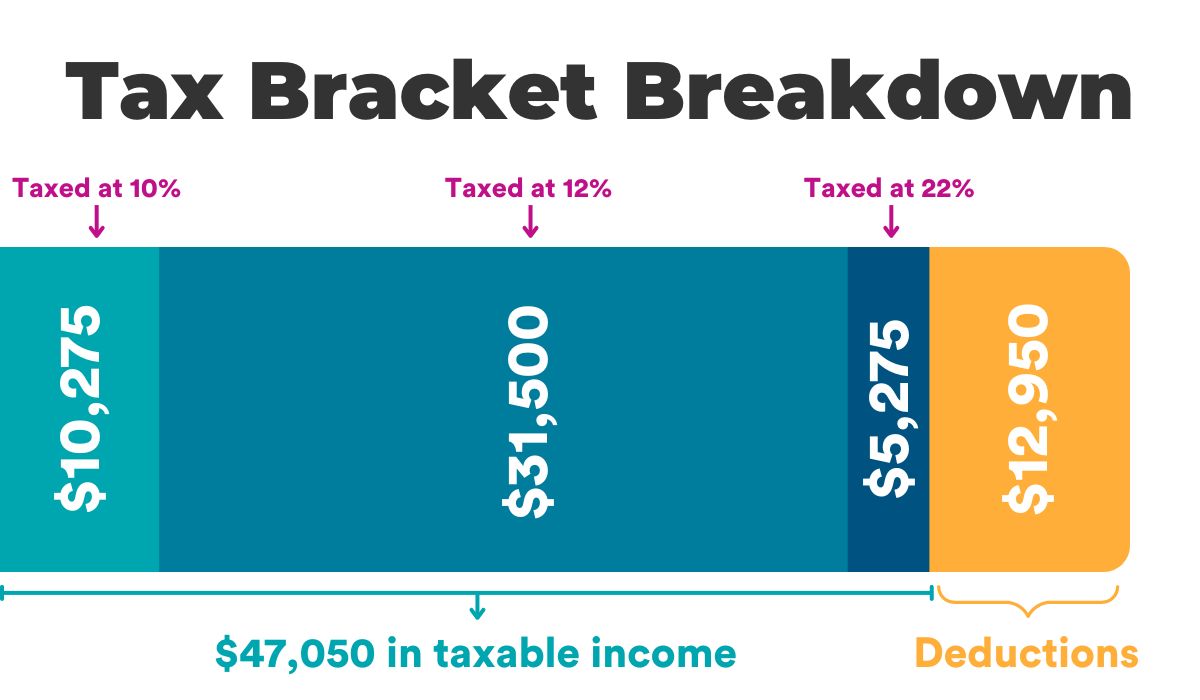

What Are Tax Brackets & How Do They Affect Your Money?

Don’t miss the video breakdown in the “Tax Bracket Example” section below! ▼ What are tax brackets and how do they affect you? Are you curious how the IRS determines the amount of money you have to pay in income tax? Do you worry your recent raise or boost in self-employment income could leave you…

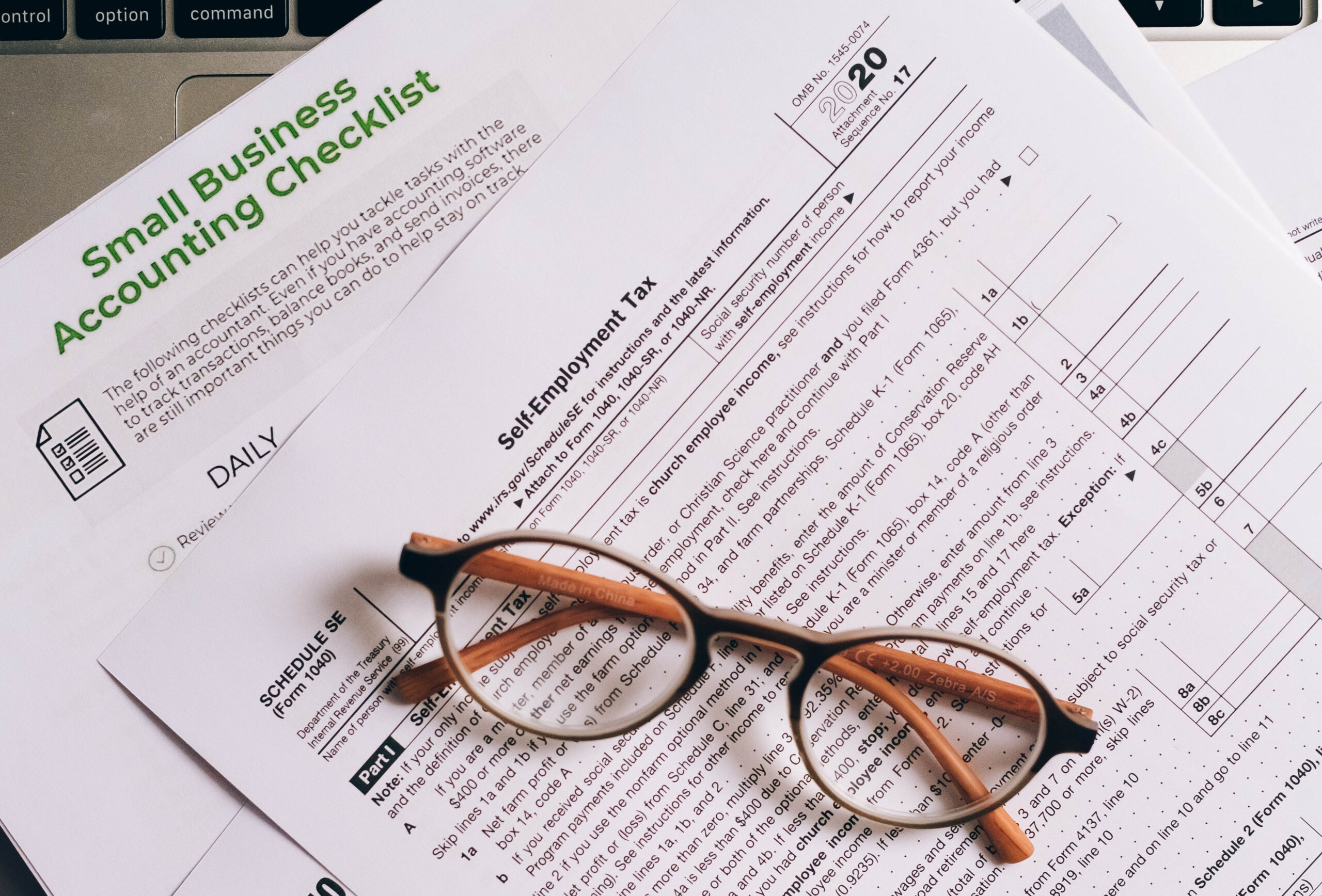

Read More5 Often Overlooked Small Business & Gig Work Expenses You Should Write Off Every Year

Is it possible you could be writing off more as a small business owner or gig worker? These 5 often overlooked write-offs may surprise you. Note: This article is for small business owners, self-employed individuals, and gig workers who report their income from those activities with their personal tax return on a Schedule C (1040)…

Read More7 tips for doing small business taxes when you have a 1099 & a W-2

When you’re juggling a full-time job and launching your small business, taxes probably aren’t the first thing on your mind. But preparing a tax return becomes more difficult when you add that small business or self-employment income into the mix. Be prepared when tax season rolls around with these 7 tips for doing small business…

Read MoreResources to Help You Take Your Small Business to the Next Level

Creating a small business can be overwhelming, but we’re here to help! We’ve curated a list of small business resources covering topics like financing, human resources, planning and operations, taxes, and more. 1) SCORE SCORE is the nation’s largest network of volunteer, expert business mentors. It’s dedicated to helping small businesses get off the ground,…

Read MoreHome Energy Tax Credits and Rebates That Can Reduce the Costs of Home Ownership

Residential energy credits aren’t just for big projects like solar panels. That said, the credits for more common upgrades such as doors, windows, and insulation have been rather limited. There was a lifetime limit of $500 for those items. But great news for homeowners: the Inflation Reduction Act changes that starting in 2023. Residential Energy…

Read MoreTips to Get Your Tax Refund Faster and When to Expect Your Refund

Waiting for a tax refund can be frustrating. It takes time for the government to process your refund and get it into your hands. But did you know there are things you can do to help speed up the process? Check out these dos and don’ts to get your refund as fast as possible. Plus,…

Read More6 Times You May Be Surprised By Unexpected Taxes

Usually, we know what income gets taxed based on our experience. But sometimes, we just don’t think about it. With our busy lives, most of us aren’t thinking about taxes all the time. So SaverLife is here to help! Here are some situations when you may have taxable income that may surprise you when you…

Read More2023 Tax Time Guide

Looking for the 2024 Tax Time guide? Check out the new guide here. 2024 Tax Time Guide This tax season, we want to make sure you receive every dollar you deserve. That’s why we’re sharing tax filing resources that are 100% FREE for you. Browse our one-stop guide to master tax time and make it…

Read MoreEverything You Need to Know About Debt And Taxes

Debt and credit can be useful tools to help reach goals, but how do they impact your taxes? Having debt, in some cases, can reduce taxes, but in most cases, it is not helpful. Having debt canceled can be incredibly helpful with personal finances and budgets, but sometimes results in more taxes. Let’s start with…

Read More6 Tax Updates You Need To Know For The 2023 Tax Season Including 1099-K, CTC & ETIC

Every year there are changes to tax law. As the tax year 2022 filing season approaches in 2023, it is a good time to review the changes for those 2022 tax returns. Understanding the tax code changes this year is more important than ever as some tax credit increases are coming to an end. 1)…

Read More