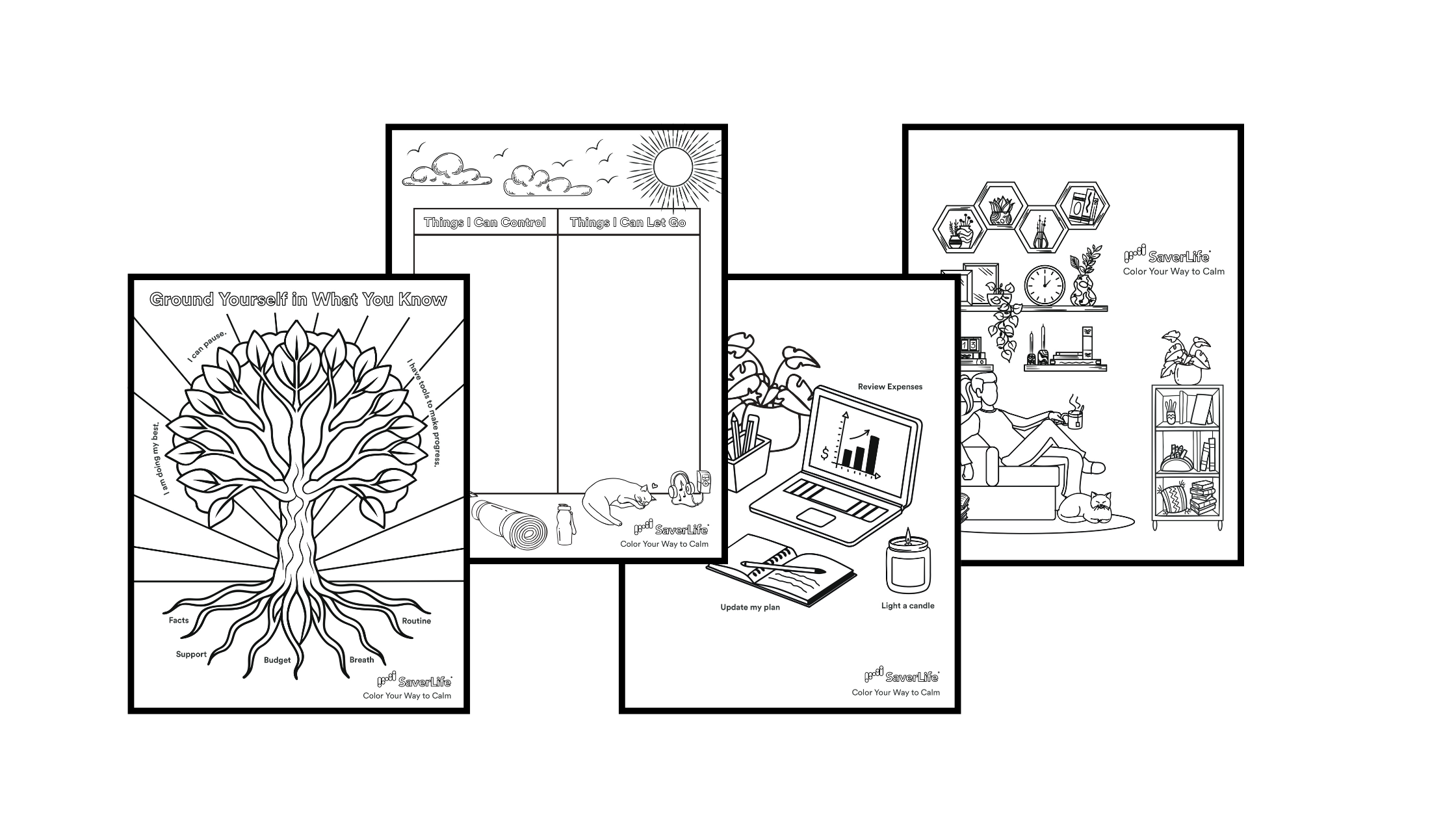

Color Your Way to Calm: A Mindful Break with a Money Twist

Back by popular demand, our money-themed calming coloring pages are here to help you unwind and reset. Right now, many of us are feeling the weight of unpredictability—whether it’s financial stress, family responsibilities, or just the day-to-day unknowns. That’s why taking a moment to pause, breathe, and refocus is more important than ever. Studies have…

Read MoreAI for Meal Planning: How Smart Tools Can Cut Your Grocery Bill

Grocery bills have gone up, even for basics like eggs and milk. It’s not just you — food inflation is impacting families across the country. Gratefully, there are a few tools that can help you make the most of your grocery dollars. AI is a free, low-effort tool that can help with meal planning and…

Read MoreMoney Prompts: How to Use AI to Save Money

AI tools are popping up everywhere these days, and while some people enjoy playing around with them, many of us are still wondering how this actually helps in real life. If you’re focused on making ends meet, paying down debt, or just trying to get through the week, using artificial intelligence (AI) might not feel…

Read MoreTaking Stock: Debt Check-In

This blog article was authored by Jesse Campbell, Content Manager at Money Management International (MMI), our SaverPerks partner organization. A new year is a new chance to reset, refocus, and start making progress on your financial goals. Is reducing debt on your radar for 2025? There’s a good chance it should be. On average, American…

Read More2025 Financial To-Do List

In a few short hours, we will be ringing in the New Year! As you prepare to close the book in 2024 and look ahead to a fresh start in 2025, you undoubtedly have lots of goals and plans. Including your finances in your plans for the new year is important. Doing so can help…

Read MoreReset Your Budget with a Post-Holiday No-Spend Challenge

While the holiday season is often a time of joy and celebration, it can lead to overspending and even debt. In 2023, 34% of Americans went into debt during the holiday season. Whether you find yourself in debt after the holidays or are ready to reset your budget and start the new year from a…

Read MoreHidden Holiday Financial Stressors

With only 8 weeks until Christmas, the holiday season is officially upon us! While it can be an exciting time filled with friends, family, and festivities, it can also bring financial stress. In fact, financial stress is often cited as one of the biggest stressors people face during the holidays. If you take a minute, you…

Read MoreMoney Moves: What to Do When You Land Your First Job

Just landed your first job? Congratulations! This is a big milestone on your financial health journey. Plus, getting your first paycheck always makes everything seem a little brighter. Getting your first job can also come with additional responsibilities and expenses. It’s important to get a handle on managing your money from the get go. Why?…

Read MoreWhat is Loud Budgeting & How Can It Help You Reach Your Goals?

The world today is filled with so much noise. From your social media feed to reality TV, it often seems like people are spending fortunes and living large. Between this noise and pressure to spend your money in social situations, it can be difficult to keep your budget in check. But this doesn’t have to…

Read MoreA Beginner’s Guide to Financial Health for Gen Z

Were you born between 1996 and 2012? If so, you’re most likely part of Gen Z: the generation that’s entering or well into their 20s. SaverLife wants to better understand our Gen Z members who are navigating their financial health journeys. From our preliminary research, we uncovered that young adults are spending significantly more on…

Read More