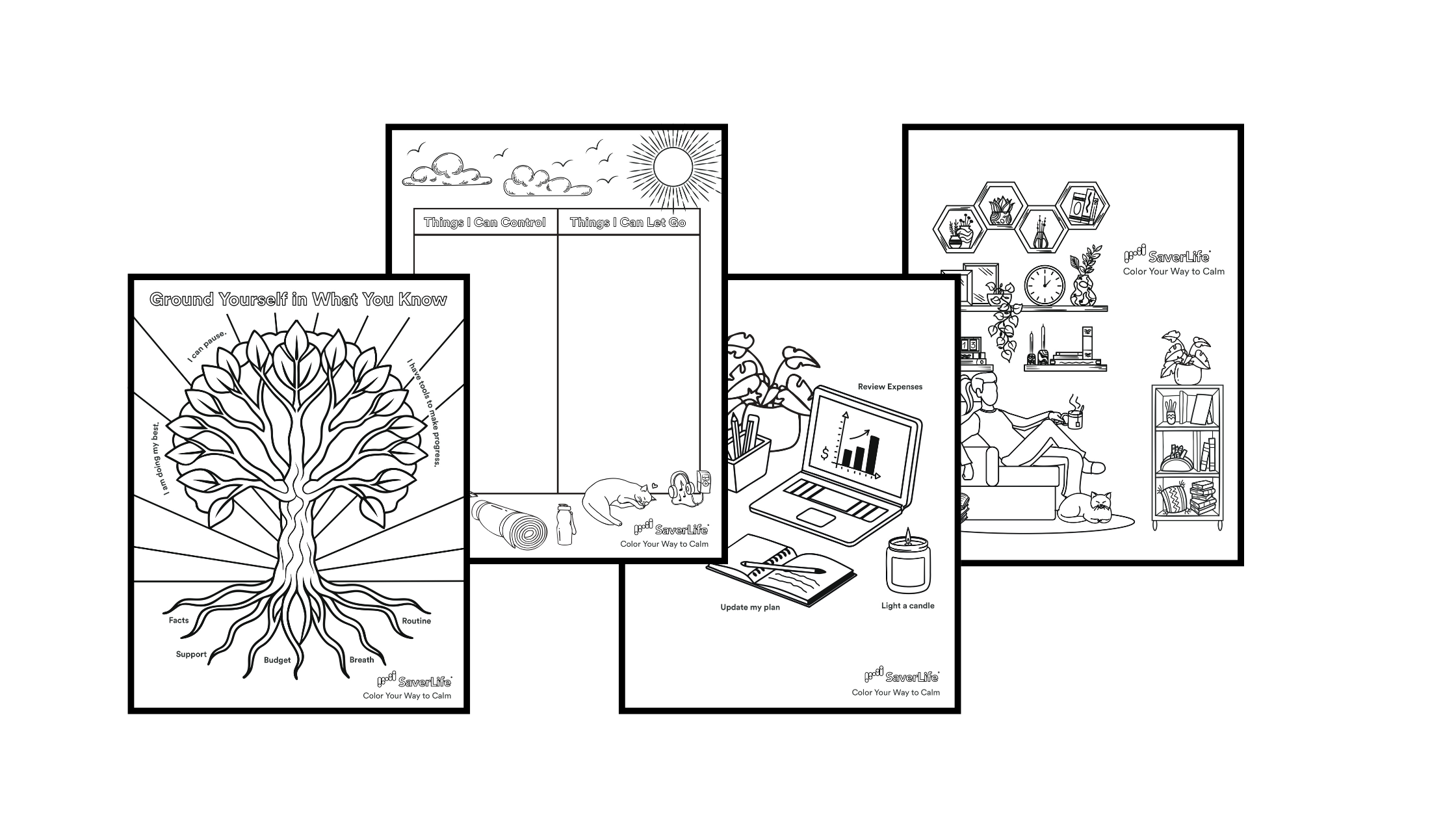

Color Your Way to Calm: A Mindful Break with a Money Twist

Back by popular demand, our money-themed calming coloring pages are here to help you unwind and reset. Right now, many of us are feeling the weight of unpredictability—whether it’s financial stress, family responsibilities, or just the day-to-day unknowns. That’s why taking a moment to pause, breathe, and refocus is more important than ever. Studies have…

Read MoreAI for Meal Planning: How Smart Tools Can Cut Your Grocery Bill

Grocery bills have gone up, even for basics like eggs and milk. It’s not just you — food inflation is impacting families across the country. Gratefully, there are a few tools that can help you make the most of your grocery dollars. AI is a free, low-effort tool that can help with meal planning and…

Read MoreYour Money, Your Power: How to Build Financial Confidence with Small Changes

Why Financial Confidence Matters When it comes to your money, even though it may not feel like it, you are in control. You have the power to decide what happens and how your money works for you. But sometimes, when you are living paycheck to paycheck or find yourself struggling to get out of debt,…

Read MoreHidden Holiday Financial Stressors

With only 8 weeks until Christmas, the holiday season is officially upon us! While it can be an exciting time filled with friends, family, and festivities, it can also bring financial stress. In fact, financial stress is often cited as one of the biggest stressors people face during the holidays. If you take a minute, you…

Read MoreMoney Moves: What to Do When You Land Your First Job

Just landed your first job? Congratulations! This is a big milestone on your financial health journey. Plus, getting your first paycheck always makes everything seem a little brighter. Getting your first job can also come with additional responsibilities and expenses. It’s important to get a handle on managing your money from the get go. Why?…

Read MoreWhat is Loud Budgeting & How Can It Help You Reach Your Goals?

The world today is filled with so much noise. From your social media feed to reality TV, it often seems like people are spending fortunes and living large. Between this noise and pressure to spend your money in social situations, it can be difficult to keep your budget in check. But this doesn’t have to…

Read MoreRainy Day Resilience: Tips for Gen Z Navigating Climate Change, Inflation & a Housing Crisis

Maybe your work hours and income have been affected by extreme temperatures. Maybe your landlord is considering installing energy-efficient appliances and increasing your rent. Or maybe you’re seeing produce prices increase at the grocery store. No matter the situation, climate change and inflation are creeping in on your daily choices, and it’s important to prepare…

Read MoreConsidering Solar Panels to Reduce Your Electricity Bill? Keep these Facts in Mind

When you’re budgeting, planning for expenses can be a challenge. One area where this hits most people’s budgets is electricity bills. This unpredictability, coupled with rising energy costs, can put a strain on your finances. This may have you wondering: how can you lower your electricity bill and make it more consistent over time? One solution…

Read More6 Tips to Start the New Year on the Right Track Financially

The holidays are a time of hustle and bustle. Between the parties, presents, and meals, other things often shift out of focus. But the new year is a time for refocusing on your goals. Whether you went over budget or just didn’t pay attention to your spending over the holidays, the new year can be…

Read More6 Holiday Hacks to Curb Impulse Shopping

Have you ever stopped to think about how much you spend around the holidays? Chances are it’s more than you think. Research shows Americans spend roughly $1,000 on Christmas each year. While some of this spending is planned, unplanned impulse spending can add up quickly. If you aren’t careful, it can derail your budget and…

Read More