Buchi’s Story: Experiences Instead of Material Items

Meet Buchi, a self-employed bookkeeper who lives and works in San Francisco. What do you do? I’m disabled and I’m self-employed with bookkeeping. I do that on the side. It’s been good for these last 9-12 years. What did your upbringing teach you about finances? (laughs) Well, to manage money responsibly. Here in the US,…

Read MoreCheranda’s Story: Celebrating Sobriety and Achieving her Financial Goals

Cheranda is an Assistant Operations Manager at a local grocery store in Portland, Oregon. How have you been? I’m 42, and this past Monday, I’ve been sober for seven years. In June, I’ll have been at my job for six years. I started off as a prep cook. During the past few years, I got…

Read MoreBrett’s Story: The Price of Debt

Meet Brett, a full-time student living in Indiana, Pennsylvania who’s pursuing his PhD degree. What do you do? I’m in the second year of my program at Indiana University, pursuing a degree in Literature and Criticism. It’s the study of literature but using theories and criticism to discuss different pieces. What did your upbringing teach…

Read MoreDaisy’s Story: Dreaming of a Purple House with Chickens

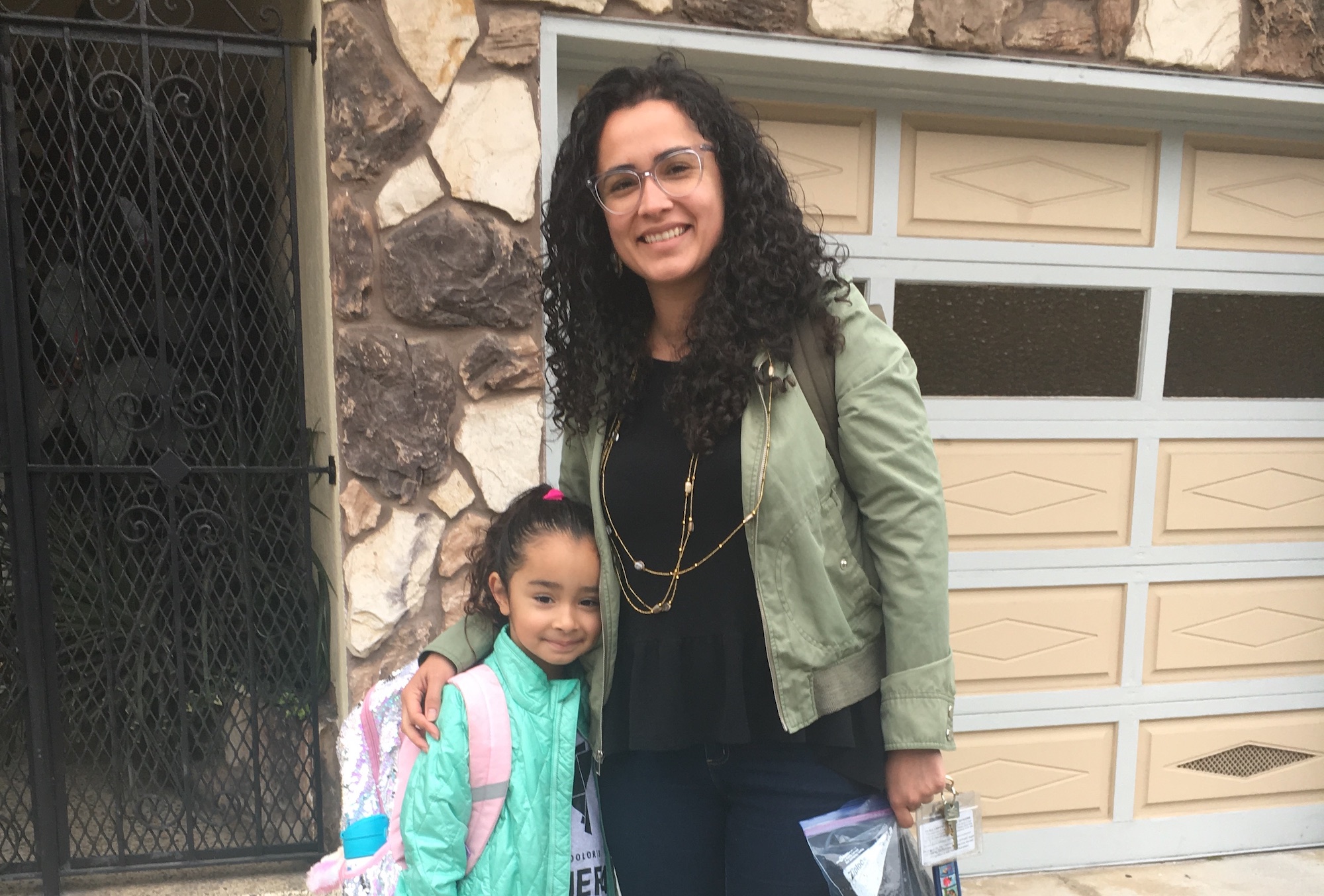

Meet Daisy, a part-time lecturer and breastfeeding peer counselor, living in San Francisco with her 5-year old daughter. What do you do for a living? I currently have two jobs and might pick up a third. I lecture a weekly class at San Francisco State University and I also have a part-time job as a…

Read MoreThe 6 Budgeting Challenges Most People Face, And How to Handle Them

When it comes to money, it’s more common to have challenges saving and budgeting than not. If you’ve found yourself caught between a rock and a hard place, there’s no need to worry or beat yourself up. These are common problems we all face, and with a few tips and tricks, you can work around…

Read More5 Emergencies to Consider When Safety Budgeting

An emergency fund should be a part of everyone’s saving priorities. It’s a nice little cushion to keep you resilient in the event of unforeseen circumstances that change your financial situation. It can be a lifeline when the unexpected happens and offers peace of mind when things seem to start taking a turn. Having an…

Read MoreCan Corporate Bottom-Up Budgeting Principles Apply to Your Personal Finances?

While there are certainly many differences between your personal spending needs and corporate spending, understanding a business-based approach to budgeting may help you see spending and saving in a different light. For instance, businesses have different techniques for budgeting. The two most common types are top-down budgeting and bottom-up budgeting. These different approaches to budgeting…

Read MoreMegan’s Story: To Value Money Means You Value Yourself

Meet Megan, an Assistant Supervisor for the Community Housing Partnership in San Francisco. What do you do at the Community Housing Partnership? I’m an Assistant Supervisor. I help our volunteer team supervise events and do marketing and partnerships with different programs like the Salvation Army. We work in areas to help prevent our clients from…

Read MoreWhat Did You Learn in 2022? SaverLife Members Share Their Key Takeaways

2022 offered many new opportunities and challenges for SaverLife members. Despite the financial obstacles that last year presented, our members navigated their savings journeys with skill, resiliency, and optimism. What did SaverLife members have to say about saving in 2022? Here are some of their key takeaways: What were some of your biggest learnings in…

Read More2023 Tax Time Guide

Looking for the 2024 Tax Time guide? Check out the new guide here. 2024 Tax Time Guide This tax season, we want to make sure you receive every dollar you deserve. That’s why we’re sharing tax filing resources that are 100% FREE for you. Browse our one-stop guide to master tax time and make it…

Read More