What can I do when there is an ongoing medical emergency?

What happens when an emergency is ongoing? My husband had a stroke, and a) can no longer work; and b) now has high medical bills. We’re drowning financially, and it is going to be an ongoing issue. Submitted by Amy A. First, we are so sorry your family is going through this difficult time. The…

Read MoreIs there anyone who will work with you one-on-one to get out of debt?

Is there anyone that works one on one to get the person to get out of debt and credit collections? Submitted by Amanda B. Credit “repair” is a hot topic and you are wise to seek out someone reputable to help you sort out the best solution for your situation. The CFPB (Consumer Finance Protection…

Read MoreAre there any legit organizations that help with credit repair?

Are there any legit organizations that help with credit repair?? I’m fearful of paying my money to a company that’s not accredited. Submitted by anonymous. The Consumer Finance Protection Bureau (CFPB) is my trusted source for this topic because they offer tips on selecting a reputable organization as well as some important questions to ask.…

Read MoreYour Money: Your Values

Hi, I’m Saundra Davis, financial coach here at SaverLife. Today, we’re going to talk about your money values. We often don’t think about how our values play in to what we do with our money. But the fact is everything you do with money makes perfect sense if you understand what you believe about money. Our…

Read MoreHow to Rebound from a Credit Slip

Credit slips can happen to anyone – and although you may panic when you see that number go in the wrong direction, sometimes even the best financial decisions may bring about a credit slip. So dust yourself off and congratulate yourself on being proactive in checking your credit score and taking actions to help it…

Read MoreMeet Your Fellow Savers

At the beginning of your journey with SaverLife, we asked you about your goals. Here’s what you and your fellow savers said! EARN Savers have big goals! YES, we do! (I’m saving too!) I’m not at all surprised that housing is at the top of our “goals” list. That makes perfect sense! Buying a home…

Read MoreDebt Consolidation: What is it and is it right for me?

If you’re dealing with multiple loans, chances are you’ve heard of debt consolidation (think of those obnoxious radio or tv ads). But what exactly is debt consolidation? Put simply, debt consolidation allows you to consolidate all of your debts into one payment. This will combine all your debt amounts, and it may offer a lower…

Read MoreWhat apps do you recommend to track your spending habits?

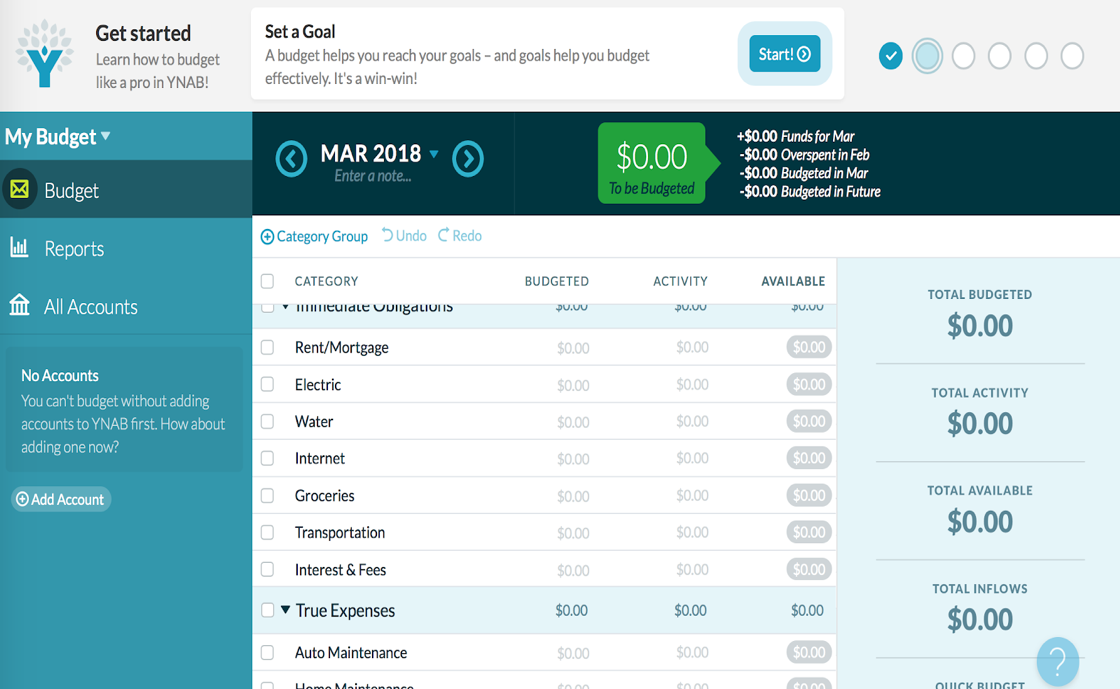

This is the interface of You Need a Budget, one of the budgeting apps I’m trying out currently. What free or low-cost software/apps do you recommend to track your spending habits? There are so many out there to choose from and some are overly complicated and others require too much work. Submitted by Brittany.…

Read MoreWhat is trailing interest and how do I avoid it?

What is “trailing interest”? I just got a credit card bill with interest charged after I paid it off! Submitted by Sasha. When you are using credit cards, timing is everything. The difference between the date you make a credit purchase and the date you pay can have a huge impact on the “cost of…

Read MoreWhy Do Different Companies Show Different Credit Scores?

Why do different companies show different credit scores? Credit Karma showed my score 70 points higher than the banks! Submitted by StillLearning. Ah, the mysteries of credit scores. Let’s get the nuts and bolts down, then we can talk about the best approach to getting the information you need. There are several credit reporting companies…

Read More