I just completed a chapter 13 bankruptcy. Can I apply for a personal loan?

“Hi, I just completed a chapter 13 bankruptcy and would like to know if I can apply for a personal loan. Thank you.” Submitted by David N. Thanks for your question about life (and credit) after bankruptcy. This is a common situation and the good news is that getting Chapter 13 debt relief is not…

Read MoreMy kids are 4 and 7. Is it too late to open a 529?

“My son is 7 and my daughter is 4. Is it too late to invest in 529 plan for them? What would be a better alternative to save for their college and financial future?” Submitted by Stella D. It is never too early or too late to start saving for college (or for anything, for…

Read MoreBuying a house seems unattainable for me. What can I do?

“Thanks you for your blog and articles to educate oneself. I hear a lots about affordable housing, which concerns me because the prices on these houses are still not attainable for people like me. I want to buy a home with the Habitat for Humanity program. Can you give insight on what it takes to…

Read MoreWhat Stock Can I Invest in That Will Earn Money with Low Risk?

“What stock can I invest in that will earn money with low risk?” Submitted by Fernando A. I’m glad you are thinking about investing while also considering the risk involved. Clearly you understand the relationship to risk and return (low risk = low return) and I am wondering about the goal of your investment plan.…

Read MoreHow can you balance saving with the asset limits on federal and state benefits?

“How can you help people who are going to get bumped off their subsidized food and housing because they have assets? Then the federal and state agencies say ‘Hey, all is well now.” They may be making more, but not enough yet to sustain themselves, landing them right back in poverty. I’ve seen this happen…

Read MoreMyRA savings accounts are being discontinued. What should I do?

“I enrolled and contributed to myRA (Roth IRA) since August 2016. The myRA.gov program is now being shut down. What should I do with my only Roth IRA/ Retirement investment?” Submitted by Brian H. Admittedly, my heart was broken when the announcement about shutting down myRA® retirement program hit the news. It wasn’t perfect, but…

Read MoreWhat can I do when there is an ongoing medical emergency?

What happens when an emergency is ongoing? My husband had a stroke, and a) can no longer work; and b) now has high medical bills. We’re drowning financially, and it is going to be an ongoing issue. Submitted by Amy A. First, we are so sorry your family is going through this difficult time. The…

Read MoreIs there anyone who will work with you one-on-one to get out of debt?

Is there anyone that works one on one to get the person to get out of debt and credit collections? Submitted by Amanda B. Credit “repair” is a hot topic and you are wise to seek out someone reputable to help you sort out the best solution for your situation. The CFPB (Consumer Finance Protection…

Read MoreAre there any legit organizations that help with credit repair?

Are there any legit organizations that help with credit repair?? I’m fearful of paying my money to a company that’s not accredited. Submitted by anonymous. The Consumer Finance Protection Bureau (CFPB) is my trusted source for this topic because they offer tips on selecting a reputable organization as well as some important questions to ask.…

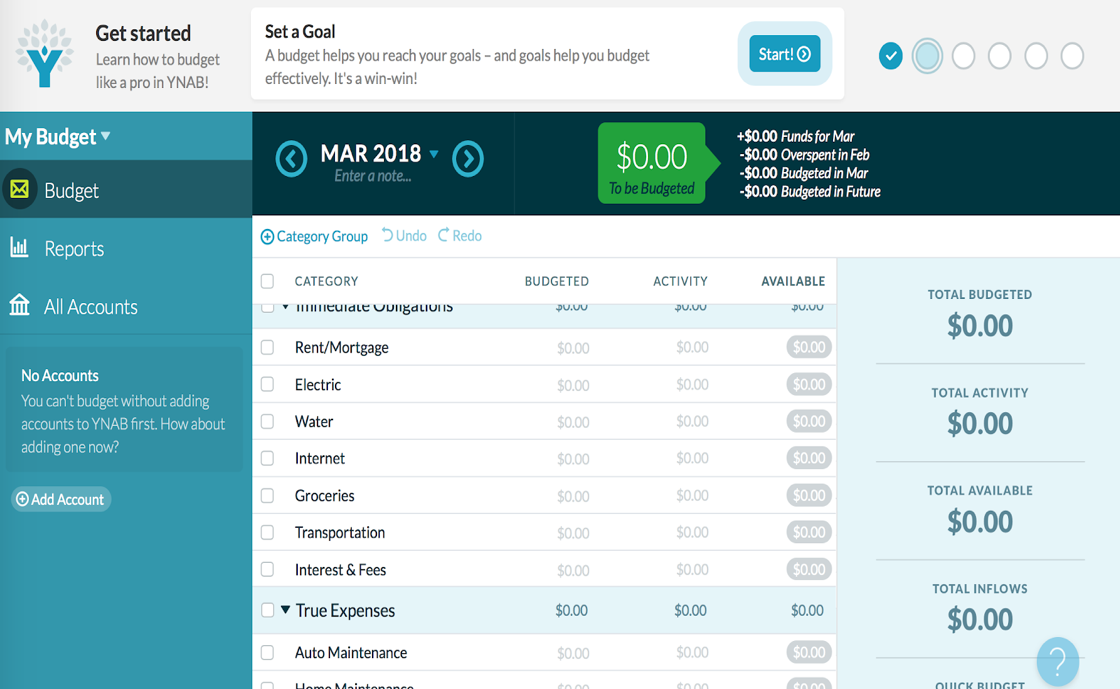

Read MoreWhat apps do you recommend to track your spending habits?

This is the interface of You Need a Budget, one of the budgeting apps I’m trying out currently. What free or low-cost software/apps do you recommend to track your spending habits? There are so many out there to choose from and some are overly complicated and others require too much work. Submitted by Brittany.…

Read More