Everything You Need to Know About Inflation

It’s almost impossible to turn on the news or scroll the headlines today and not be confronted by rising inflation. With an inflation rate of 8.5% in July, it is easy to see why. The government typically works to target 2% inflation to keep price changes low while encouraging economic growth. So the high inflation…

Read MoreWhat Is a Roth IRA?

A Roth IRA (Individual Retirement Account) allows you to save up to a certain amount of money in a non-deductible, after-tax account. Contributions to the account are not tax-deductible, but funds grow tax-free. Any withdrawals made after age 59 ½ are tax-free. The annual contributions limit, set by the Federal government, is $6,000 for 2021…

Read MoreWhat is the Rule of 72?

Are you considering investing money? If so, you should know about the Rule of 72. It helps you determine how long it will take for your money to grow a certain amount. The Rule of 72 allows you to figure out how long it will take for an investment to double at a given annual…

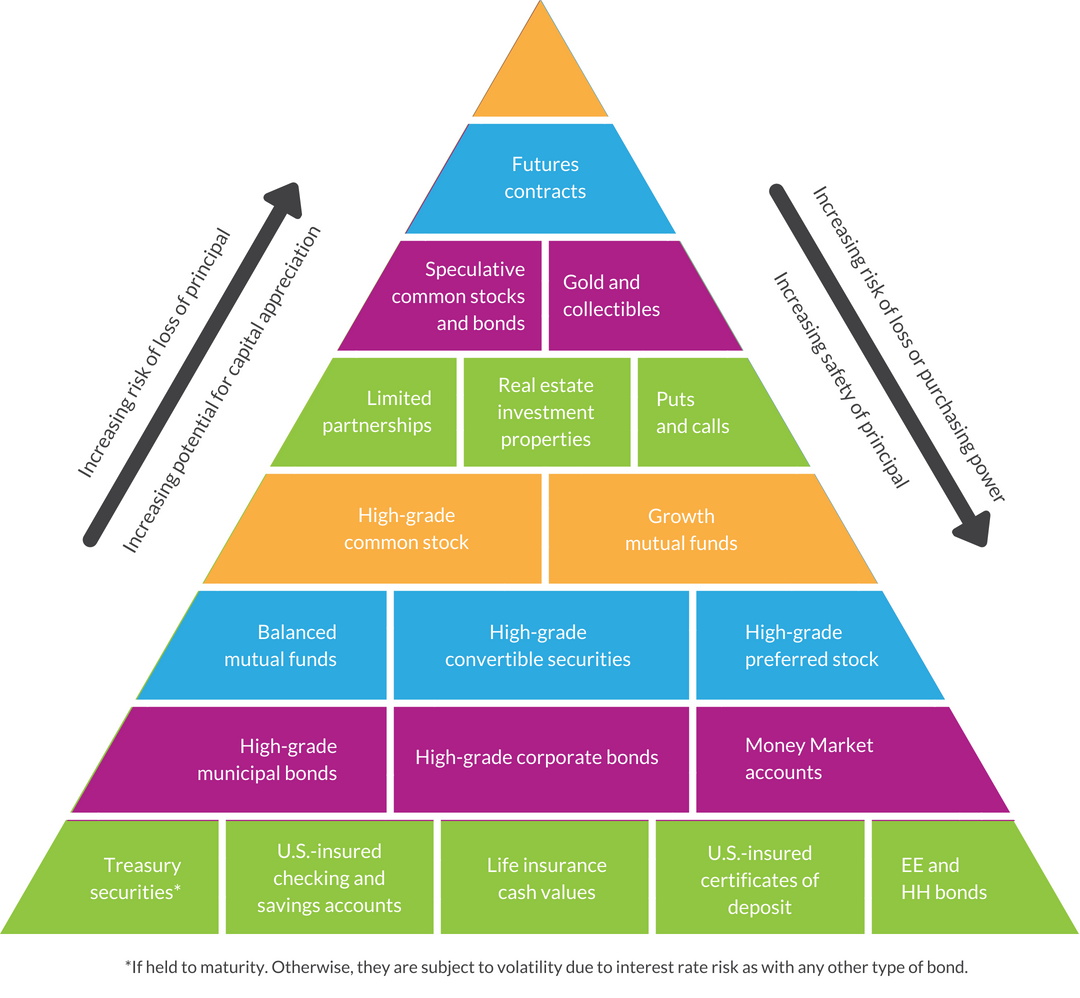

Read MoreHow Can I Get Started with Low-Risk Investments?

How do I begin with low risk investments? For example CD’s, money market accounts, etc. Submitted by Deirel M. First of all, way to go! Investing is all about preparing for your future and the fact that you’re clear that you want low risk is an appropriate first step. Are You Ready to Start Investing?…

Read MoreWhen Should I Start Investing?

You may have heard the Chinese proverb: the best time to plant a tree was 20 years ago. The second-best time is now. The same is true with investing. If you think you’ll have time to get started later, you should see how that’s working out for older generations. The Power of Compound Interest If…

Read MoreInvesting 101: Stocks, Bonds, and More

One of the most common questions I get asked is about investing. How should I start investing? What investment options do you recommend? What is a low-risk investing option? Don’t worry, we’re going to get there. But first, let’s start with something more basic. Investing is a means to an end, not an end itself…

Read MoreThinking about Investing? Investment-Savvy Checklist

A lot of members tell us they’re interested in investing. Maybe you’re starting to save regularly, and you’re wondering how your money can work for you instead of sitting passively in a bank account. What Are Your Goals? Before jumping into investment strategies, start with this basic question: what is the point of investing to…

Read MoreWhat Stock Can I Invest in That Will Earn Money with Low Risk?

“What stock can I invest in that will earn money with low risk?” Submitted by Fernando A. I’m glad you are thinking about investing while also considering the risk involved. Clearly you understand the relationship to risk and return (low risk = low return) and I am wondering about the goal of your investment plan.…

Read MoreReady to Start Investing? 6 Tips for Avoiding Scams

You’ve worked hard to get where you are financially, and investing might seem like the next step. But sometimes the financial landscape (and especially the internet) is like the Wild West. Let’s go through some tips to have in mind and common pitfalls to watch out for when you start investing. Know Your “Why” With…

Read More