Forget resolutions – it’s time for a financial New Year’s revolution!

It’s New Year’s resolution season! Even though many resolutions don’t make it until the end of winter, it can still be a helpful exercise for many people. Many years ago, I decided to begin each year with a financial revolution! Check out how Merriam Webster defines revolution: the action by a celestial body of going round…

Read MoreHow to Prepare for a Family Financially

Since we know that everything affects everything, let’s talk about how our financial lives are impacted by our families. Over 80% of SaverLife members live with at least one other person—be that a parent, child, partner, or roommate—and even if you are single, you may have heard that having a baby can really break the…

Read MoreWhat is Lifestyle Inflation?

Have you noticed that even when your income increases, it can feel like you still don’t have more money leftover at the end of the month? That’s because often, when our income increases, our expenses do too. This is a very real phenomenon called lifestyle inflation. It can sneak up on us despite our best…

Read MoreTeaching Your Kids to Save Money

Think about the lessons you learned about money. How do the messages you heard in your early years impact the way you view and manage money today? Research shows that lifelong money habits are formed early. In fact, psychologists believe that by age 7 (I know, right?), kids have already developed long-lasting attitudes about money.…

Read MoreLauren’s Story: Money Won’t Make You Happy

Meet Lauren, a mother of four daughters (including a two-month-old baby!) who lives with her husband in Conway, South Carolina. What do you and your husband do? My husband is a produce manager at our neighborhood market. I am current filing for disability. What did your upbringing teach you about finances? Money doesn’t grow on…

Read MoreHow much income is enough?

How much income is enough? Submitted by Charles A. We would all like to know this! What is the income we need to lead a happy life? To find the true answer to this question, let’s take a tour of our personal habits. Enough? For who? Where? With what lifestyle? Will it be enough forever…

Read MoreWhat is an Opportunity Cost?

Opportunity cost is an economics concept with huge implications in every aspect of our lives. To put it simply, when you say “yes” to one thing, you are saying “no” to another. Opportunity Cost in the Real World Let’s try an example. Say your goal is to build healthier habits by exercising every day. When…

Read More3 Reasons to Set Up an Automatic Savings Plan

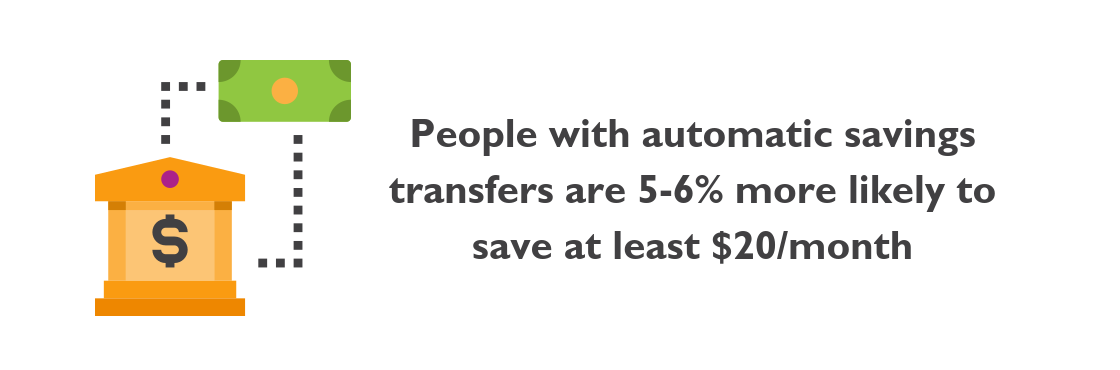

There are endless strategies for saving money, but one that comes up again and again is setting up an automatic transfer. Lots of research, including our research here at SaverLife, shows that this is a good way to save more. In fact, SaverLife members who set up automatic savings transfers are 5-6% more likely to…

Read More2018: Thank you for a wonderful year!

Happy holidays from all of us at SaverLife! 2018 has been a big year for us. We’ve been busy creating new ways to reward you for saving and learning more about what actually helps people save. Here are just a few highlights from 2018: You won prizes for saving every week In 2018, we launched…

Read MoreHow to Be a Holiday Hero while Sticking to a Budget

Holidays can be filled with both joy and stress. As a starting point, think about the end of the holiday season. How do you want to feel? What experiences are important to you? And of course, what do you want your credit card balance to look like? What are the holidays about? As you go…

Read More