Top 10 Household Expenses to Consider When Creating Your Family Budget

The largest chunk of a family’s budget typically goes toward housing and household expenses, according to QuickBooks. Covering such big costs every month can be overwhelming, but building a solid budget for your household expenses can help you feel prepared and less stressed. Average Household Expenses In 2023, housing is the largest expense most families…

Read MoreCheap Date Night Ideas for Couples on a Budget

A lot of people ask if it’s possible to get out and have fun as a couple when you’re watching your spending and prioritizing saving and debt payoff. The answer is, “Yes!” It may take a different approach to date night, but trying new things together is worth the extra planning. First, check out your…

Read More4 Thrifty Tips to Treat Yourself When You’re on a Budget

Are you concerned that living on a budget means there’s no room for special treats? Having a plan and goals for our money often means reducing overspending, so we can achieve stable finances and security. However, there are ways to treat yourself even when on a budget. Here are some tips for how to treat…

Read MoreDaisy’s Story: Dreaming of a Purple House with Chickens

Meet Daisy, a part-time lecturer and breastfeeding peer counselor, living in San Francisco with her 5-year old daughter. What do you do for a living? I currently have two jobs and might pick up a third. I lecture a weekly class at San Francisco State University and I also have a part-time job as a…

Read MoreHow to Prepare for a Family Financially

Since we know that everything affects everything, let’s talk about how our financial lives are impacted by our families. Over 80% of SaverLife members live with at least one other person—be that a parent, child, partner, or roommate—and even if you are single, you may have heard that having a baby can really break the…

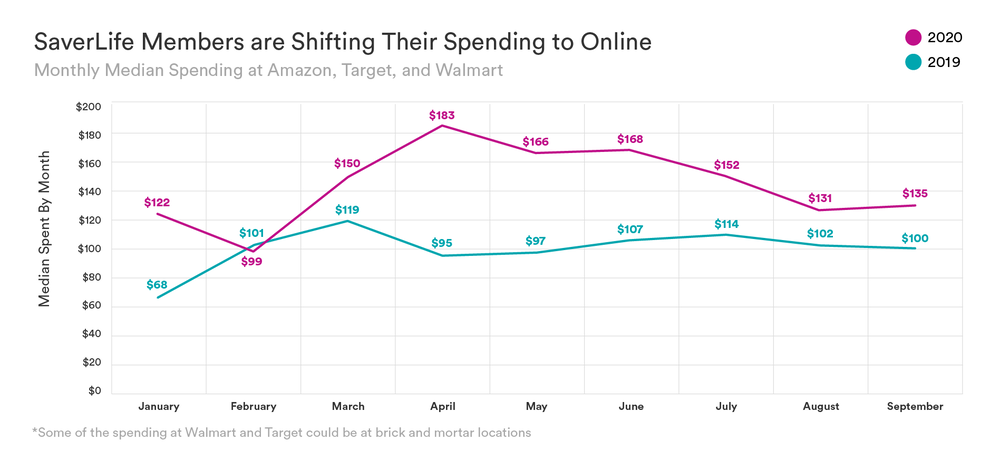

Read MoreIs Online Shopping the Way to Go This Holiday Season?

With people staying at home more this year, it’s no surprise that spending at Amazon, Target, and Wal-Mart, three of the largest online retailers in the country, has increased. Whether it’s for convenience or safety, it doesn’t look like this trend in shopping online will be stopping anytime soon. And with Black Friday and Cyber…

Read More5 Tips to Stay Out of Debt on Black Friday

Your No-Debt Black Friday Survival Guide As a veteran, I often get eye rolls from my kids when I use military analogies to describe events. But as a financial coach, I can’t help but see Black Friday as an epic battle. You’re knee-deep in the trenches of holiday shopping goals and you’re experiencing the rapid…

Read MoreScratch & Save Has A New Home

Scratch & Save has moved to our new Points Store. After much feedback from SaverLife members and countless hours spent perfecting the process, we’re proud to re-launch the new and improved Scratch & Save challenge! “The digital scratch cards I earn weekly are very motivating. It makes me want to build upon the savings each…

Read MoreNew Years Anti-Resolutions for 2020

I’m going to suggest something a little radical for the new year and the new decade, 2020. Instead of focusing on a new year’s resolutions, consider listing the things you are going to stop doing. Ideally, these should be self-sabotaging habits and behaviors that prevent you from achieving your goals. Here are a few ideas…

Read MoreTiffany’s Story: 100% Self-Made, Independent, and Proud of It

Meet Tiffany, an insurance company Customer Service Expert who lives in Michigan with her six-year-old son. What did your upbringing teach you about finances? I was always a hard worker and strived to make my own money. I’ve saved money to buy the things I wanted or felt I deserved. I pride myself on being…

Read More