How to Get Childcare Assistance and Build Care Costs into Your Budget

One of the largest expenses parents may face, especially during the first few years of their child’s life, is childcare. According to Illumine, the average cost of childcare in the US is $14,760 per year. While this cost does vary from state to state, it’s clear that the cost to cover childcare can put a…

Read MoreTop 10 Household Expenses to Consider When Creating Your Family Budget

The largest chunk of a family’s budget typically goes toward housing and household expenses, according to QuickBooks. Covering such big costs every month can be overwhelming, but building a solid budget for your household expenses can help you feel prepared and less stressed. Average Household Expenses In 2023, housing is the largest expense most families…

Read MoreBarbara’s Story: Service to Others

Barbara is an artist who lives in Carrboro, North Carolina. She is an active member of her church and a volunteer in her community. Who lives in your household? Just me. I have four grown children, but one of my sons Joel died a year ago in February. That’s part of why I’m paying off…

Read MoreGrab a Friend! Social Strategies to Help You Save

There is strength in numbers! This is especially true when you’re trying to reach your goals and change behaviors. Weight Watchers uses this principle to support healthy eating, and Alcoholics Anonymous uses it to encourage sober living. Emerging research shows that peer support can increase your confidence and sense of control. Social support also makes…

Read MoreDo you recommend credit consolidation?

Do you recommend credit consolidation to improve scores and decrease debt? Submitted by Natasha P. There are two parts to this question, so let’s dig into them separately. Improving Your Credit Score Whenever a financial institution pulls your credit with the purpose of offering you a loan, your score may be affected. Closing a credit…

Read MoreI just completed a chapter 13 bankruptcy. Can I apply for a personal loan?

“Hi, I just completed a chapter 13 bankruptcy and would like to know if I can apply for a personal loan. Thank you.” Submitted by David N. Thanks for your question about life (and credit) after bankruptcy. This is a common situation and the good news is that getting Chapter 13 debt relief is not…

Read MoreWhat is a financial health score?

Congrats on taking this step in your SaverLife journey! Your score is on a scale of 1 to 100. Here is how to read it: 0-39: You might feel like one financial emergency, like a blown tire or unexpected medical bill, would set you back for months. It’s hard to devote time and resources to…

Read MoreWhat does it mean to “pay yourself first”?

Hi, I’m Saundra Davis, SaverLife’s financial coach. Let’s talk a little bit about the golden rule of saving: pay yourself first. So many people say, “I’m going to wait and save after I’ve paid all my bills and I’ll save what’s left,” but we all know what happens then. Very seldom is there anything left. So the idea of…

Read MoreSaving for College

Graduation celebrations are all around us. I think this is a wonderful time to think about what college savings means in your life and for your family. Find your “why” As exciting as college can be, the financial burden is often high. So take some time now to think about your motivations. Are you…

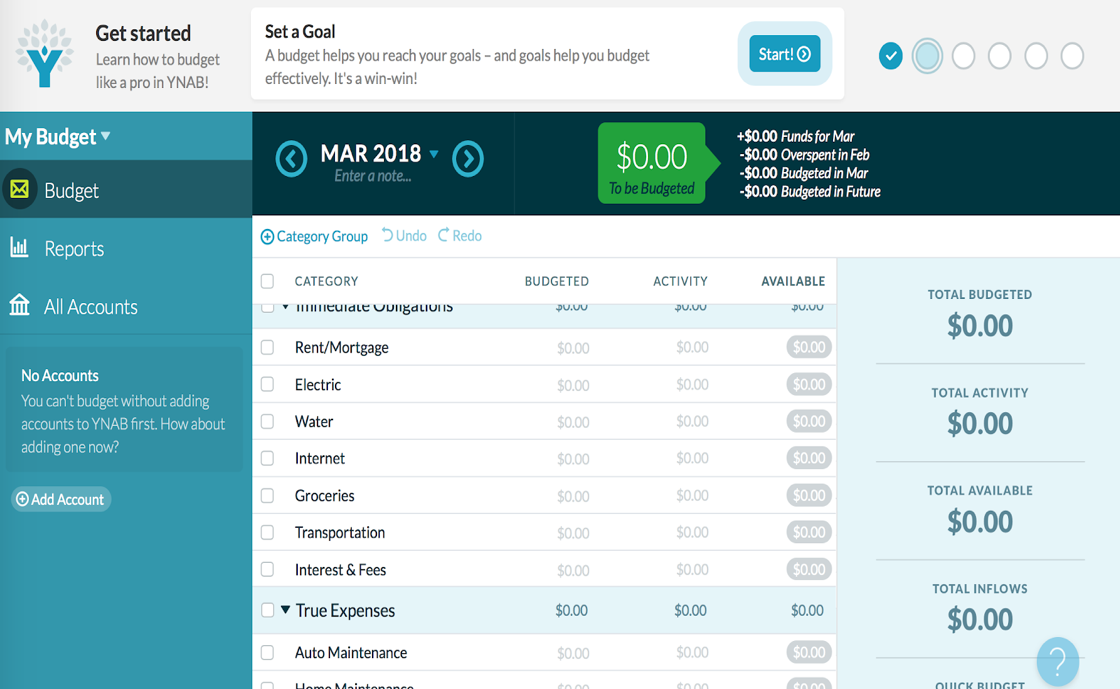

Read MoreWhat apps do you recommend to track your spending habits?

This is the interface of You Need a Budget, one of the budgeting apps I’m trying out currently. What free or low-cost software/apps do you recommend to track your spending habits? There are so many out there to choose from and some are overly complicated and others require too much work. Submitted by Brittany.…

Read More