5 Tips to Protect Your Credit After a Natural Disaster

Did you know your credit can be impacted by climate change? If you experience a severe weather event — like flooding, wildfires, or a hurricane — you might need to: On top of this, you’d still be expected to keep up with your normal expenses, like rent or mortgage payments, utility bills, childcare costs, and…

Read MoreOmar’s Story: Establishing Credit is the Foundation of Wealth

Meet Omar, a full-time college student living in San Francisco, CA with his parents and 21-year old son. What do you do? I’m studying behavioral science and addiction counseling at the City College of San Francisco. I want to be a part of the solution of dealing with all the pain that’s in the world—or…

Read MoreBrett’s Story: The Price of Debt

Meet Brett, a full-time student living in Indiana, Pennsylvania who’s pursuing his PhD degree. What do you do? I’m in the second year of my program at Indiana University, pursuing a degree in Literature and Criticism. It’s the study of literature but using theories and criticism to discuss different pieces. What did your upbringing teach…

Read MoreDaisy’s Story: Dreaming of a Purple House with Chickens

Meet Daisy, a part-time lecturer and breastfeeding peer counselor, living in San Francisco with her 5-year old daughter. What do you do for a living? I currently have two jobs and might pick up a third. I lecture a weekly class at San Francisco State University and I also have a part-time job as a…

Read MoreNew Years Anti-Resolutions for 2020

I’m going to suggest something a little radical for the new year and the new decade, 2020. Instead of focusing on a new year’s resolutions, consider listing the things you are going to stop doing. Ideally, these should be self-sabotaging habits and behaviors that prevent you from achieving your goals. Here are a few ideas…

Read MoreTiffany’s Story: 100% Self-Made, Independent, and Proud of It

Meet Tiffany, an insurance company Customer Service Expert who lives in Michigan with her six-year-old son. What did your upbringing teach you about finances? I was always a hard worker and strived to make my own money. I’ve saved money to buy the things I wanted or felt I deserved. I pride myself on being…

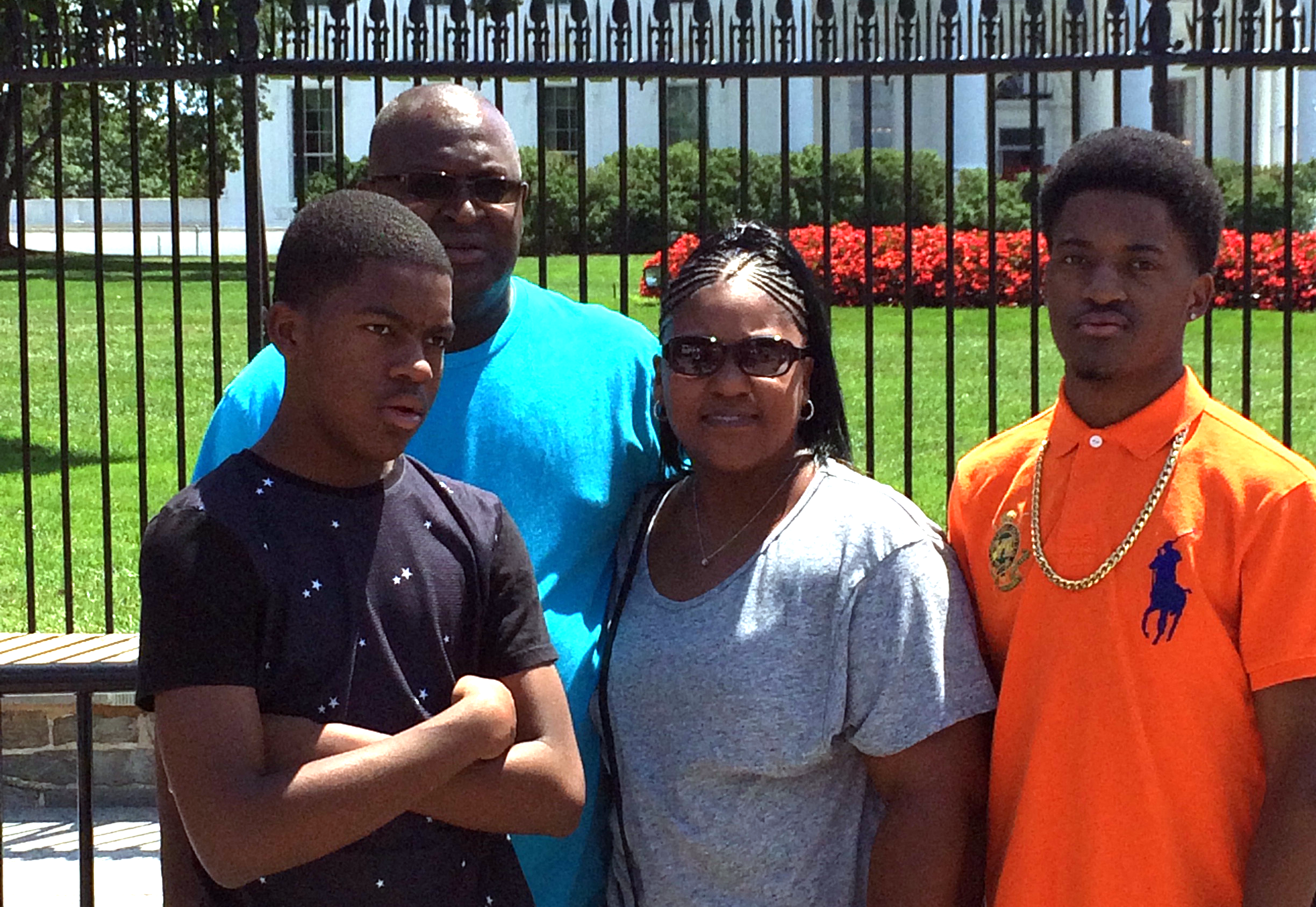

Read MoreSylvia’s Story: Home Ownership in the Future

Meet Sylvia, an HR Manager for the Clark County School District in Nevada. She’s a Las Vegas native who lives with her husband and two adult sons. What did your upbringing teach you about finances? Nothing! That’s why I’m in debt now. I don’t think I was ever taught how to save or how important…

Read MoreKiara’s Story: Maybe Money Can’t Buy Happiness, But It Can Buy Security

Meet Kiara, who lives in Taylor, Michigan with her 11-month-old daughter and her two young cousins. What do you do? I don’t have a job. I take care of my daughter and my two cousins because I have a kinship guardianship for them. One is my biological cousin and the other is his half-brother. Their…

Read MoreWhy isn’t my credit score improving?

I’ve been paying my bills every month on time and nothing changes on Credit Karma. I feel like I’m stalking the app. What should I do? Submitted by Michelle S. Congrats on paying your bills on time! Can we just celebrate that for a moment? What Impacts Your Credit Score Paying your bills will not…

Read MoreMichael’s Story: Make Your Money Work For You

Meet Michael, a substance abuse counselor who lives in San Diego, California. What do you do? I’m a substance abuse counselor. I’ve been doing it for about two years now – midlife career change. Unfortunately, it’s one of the fastest growing professions in the US, which doesn’t bode well for us. What did your upbringing…

Read More