What is Lifestyle Inflation?

Have you noticed that even when your income increases, it can feel like you still don’t have more money leftover at the end of the month? That’s because often, when our income increases, our expenses do too. This is a very real phenomenon called lifestyle inflation. It can sneak up on us despite our best…

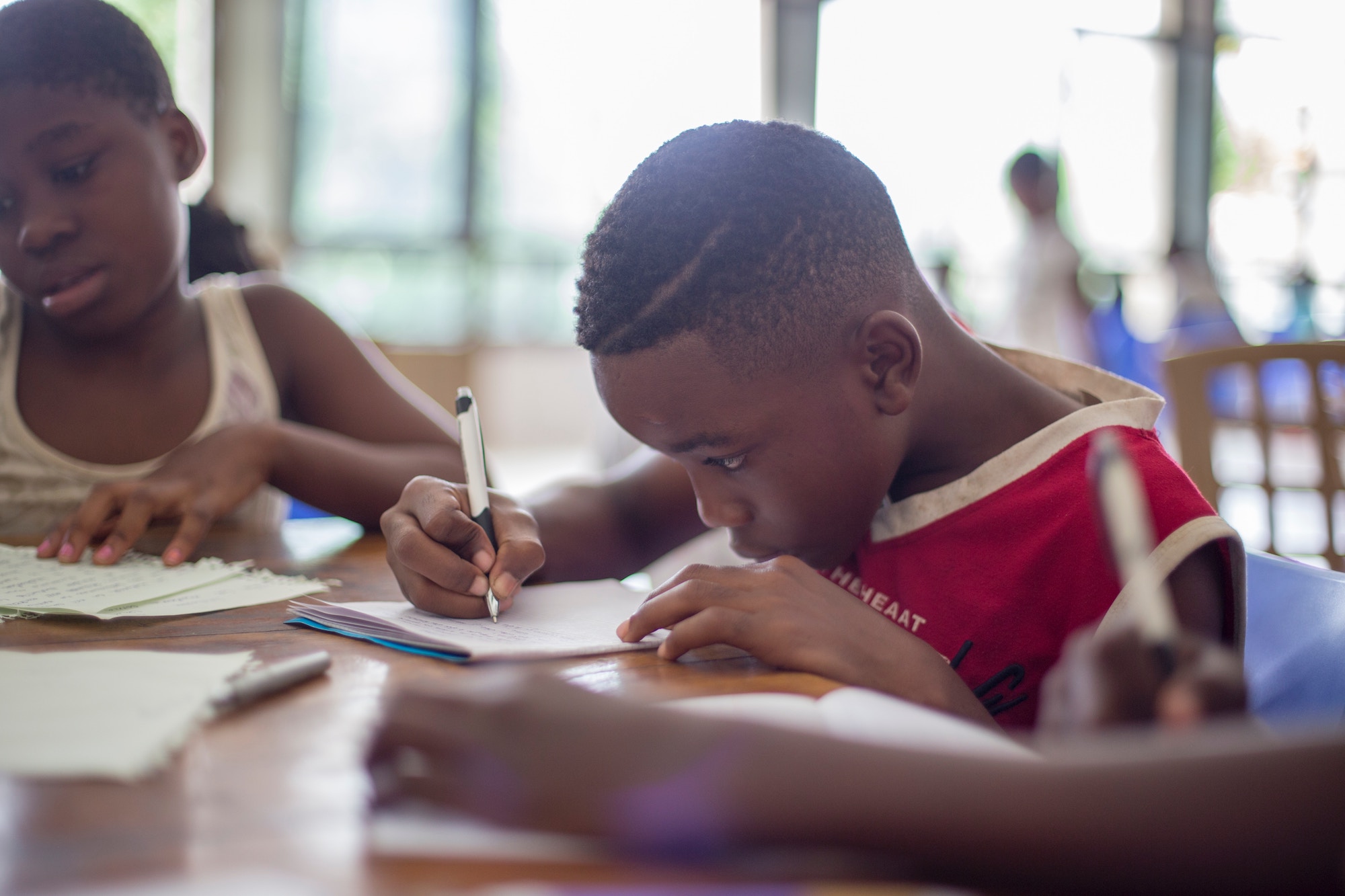

Read MoreMy kids are 4 and 7. Is it too late to open a 529?

“My son is 7 and my daughter is 4. Is it too late to invest in 529 plan for them? What would be a better alternative to save for their college and financial future?” Submitted by Stella D. It is never too early or too late to start saving for college (or for anything, for…

Read MoreWhat is a financial health score?

Congrats on taking this step in your SaverLife journey! Your score is on a scale of 1 to 100. Here is how to read it: 0-39: You might feel like one financial emergency, like a blown tire or unexpected medical bill, would set you back for months. It’s hard to devote time and resources to…

Read MoreReady to Start Investing? 6 Tips for Avoiding Scams

You’ve worked hard to get where you are financially, and investing might seem like the next step. But sometimes the financial landscape (and especially the internet) is like the Wild West. Let’s go through some tips to have in mind and common pitfalls to watch out for when you start investing. Know Your “Why” With…

Read MoreSaving for College

Graduation celebrations are all around us. I think this is a wonderful time to think about what college savings means in your life and for your family. Find your “why” As exciting as college can be, the financial burden is often high. So take some time now to think about your motivations. Are you…

Read MoreHow to Use the 80-20 Rule for Saving Money

Following money-saving rules isn’t easy. You have to face up to your finances as they are and without embellishments. You have to learn how to budget and save money. The toughest bit is that you have to bury certain desires and defer others to another time. Whatever your bank balance is at the moment, it takes guts to…

Read More