Andrew’s Story: The Pursuit of a Minimalist Lifestyle

Meet Andrew, a recent newlywed living in Daly City, CA with his wife and their 13-year old son. What do you do? I work for the San Francisco Public Utilities Commission in the Water Resources Department. I’ve been at this position for a little over three years, but I’ve been with the company for over…

Read MoreHow to Prepare for a Family Financially

Since we know that everything affects everything, let’s talk about how our financial lives are impacted by our families. Over 80% of SaverLife members live with at least one other person—be that a parent, child, partner, or roommate—and even if you are single, you may have heard that having a baby can really break the…

Read MoreNew Years Anti-Resolutions for 2020

I’m going to suggest something a little radical for the new year and the new decade, 2020. Instead of focusing on a new year’s resolutions, consider listing the things you are going to stop doing. Ideally, these should be self-sabotaging habits and behaviors that prevent you from achieving your goals. Here are a few ideas…

Read MoreTeaching Your Kids to Save Money

Think about the lessons you learned about money. How do the messages you heard in your early years impact the way you view and manage money today? Research shows that lifelong money habits are formed early. In fact, psychologists believe that by age 7 (I know, right?), kids have already developed long-lasting attitudes about money.…

Read MoreWhat does saving mean to you?

At SaverLife, we talk a lot about how important it is to save. But defining what it means to save is surprisingly difficult! Consider this scenario: You transfer $5 from your checking to savings account every week all year. At the end of the year, your car needs some repairs. You withdraw all the money…

Read MoreWhat does it mean to “pay yourself first”?

Hi, I’m Saundra Davis, SaverLife’s financial coach. Let’s talk a little bit about the golden rule of saving: pay yourself first. So many people say, “I’m going to wait and save after I’ve paid all my bills and I’ll save what’s left,” but we all know what happens then. Very seldom is there anything left. So the idea of…

Read MoreTax refunds are used for bills, healthcare, and – yes – having some fun!

Last month, we talked about how Savers used their 2017 tax refunds. This month, we’re diving deeper into how saving and spending changed after Savers got their refunds. Refunds are used to play catch-up In the months leading up to tax season, many people have to put off bills or delay healthcare. We learned that…

Read MoreHow can I manage money with a partner who has different money habits?

Do you have any advice for managing money and budgets with a partner who has a different view of spending and saving than I do? Submitted by anonymous. Ah, love and money! This can be blissful or stressful. For many people, money can make or break your relationship. It is pretty common to partner with…

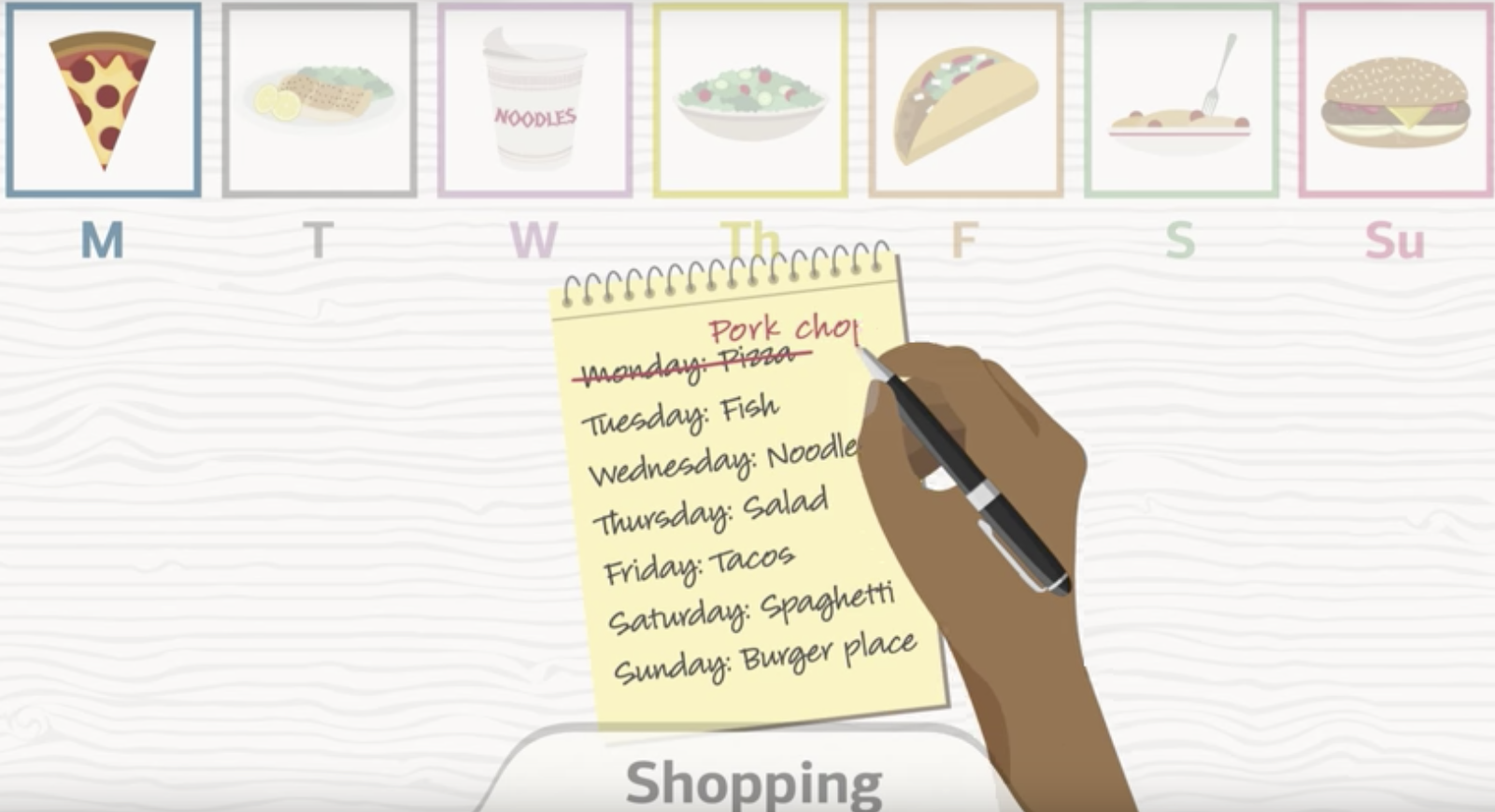

Read MoreHow to Save Money Every Day

Making simple changes to your spending can be an easy way to help you start saving. Learn how to save money on everyday expenses like groceries, transportation and entertainment. This video will show you easy changes to make so you can start saving. Here are some of the fun ideas suggested in this video: Make…

Read MoreAre You On Track? Reevaluating Your Financial Priorities

Crash Course in Financial Flexibility Our lives are complex, and that’s usually a good thing because it keeps life interesting. But when it comes to our money, the more complex our situation, the more challenging it is to manage competing priorities. What’s the Opportunity Cost? We suspect you have more than one thing you want…

Read More