How much should I put in my 401(k)?

If you’re fortunate enough to have an employer who offers a 401(k), you should seriously consider participating. A 401(k) allows you to lower your tax bill and potentially build wealth through the stock market. Here’s how to figure out how much you should contribute. The power of the employer match You should contribute at least…

Read MoreHow Can People on Government Assistance Save for Retirement?

“Where are the best places for people on state assistance to start saving for retirement? I’m looking for something with low starting balances and low monthly transfers to the account. Do you recommend any financial companies, savings accounts, government-issue bonds, stock market?? I am so confused!” Submitted by Jessica L. I want to acknowledge your…

Read MoreWhat is a financial health score?

Congrats on taking this step in your SaverLife journey! Your score is on a scale of 1 to 100. Here is how to read it: 0-39: You might feel like one financial emergency, like a blown tire or unexpected medical bill, would set you back for months. It’s hard to devote time and resources to…

Read MoreMyRA savings accounts are being discontinued. What should I do?

“I enrolled and contributed to myRA (Roth IRA) since August 2016. The myRA.gov program is now being shut down. What should I do with my only Roth IRA/ Retirement investment?” Submitted by Brian H. Admittedly, my heart was broken when the announcement about shutting down myRA® retirement program hit the news. It wasn’t perfect, but…

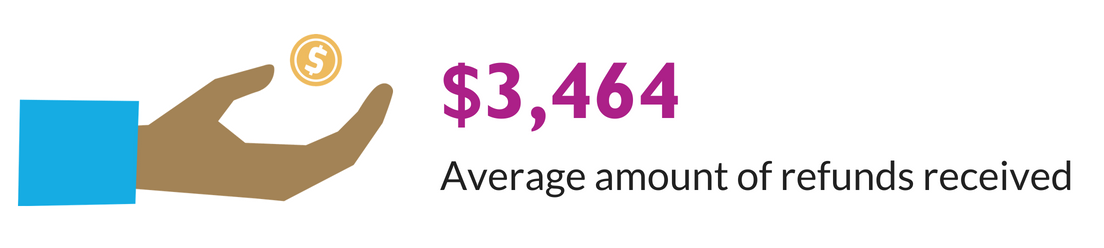

Read MoreHow do you use your tax refund?

Every month, part of your paycheck is sent straight to the government to pay your taxes. But at the end of the year, most people owe less than they’ve already paid – so they get money back from the government. These tax refunds are a huge influx of money for many American families. If you’re…

Read MoreMeet Your Fellow Savers

At the beginning of your journey with SaverLife, we asked you about your goals. Here’s what you and your fellow savers said! EARN Savers have big goals! YES, we do! (I’m saving too!) I’m not at all surprised that housing is at the top of our “goals” list. That makes perfect sense! Buying a home…

Read MoreSteps to Get Retirement Ready at Every Age

You’re never too old or too young to prepare for retirement. Sure, starting early is best (you can do more with less), but if you’re just getting started, focus on what you CAN do rather than what you missed out on. Here’s the deal. If you’re in your 20s: Get ready! Start NOW and save regularly.…

Read MoreFour Myths about Personal Finance

There are a lot of financial myths out there that simply aren’t true! Making good financial decisions starts with having the correct information you need to make those decisions. I’m going to go through four common myths about personal finance to get to the bottom of those misconceptions. 1. “Paying rent is throwing away money.”…

Read More