2025 Tax Time Guide

This tax season, we want to make sure you receive every dollar you deserve.

That’s why we’re sharing tax filing resources that are 100% FREE. Browse our guide to master tax time and make it your bonus season.

2025 Tax Time Activities

We’re giving out $24,000 in cash rewards February through April!

You have 3 ways to win:

1) Tax Time Pledge

2) Savings Challenges

3) Activities

Tax Time Resources

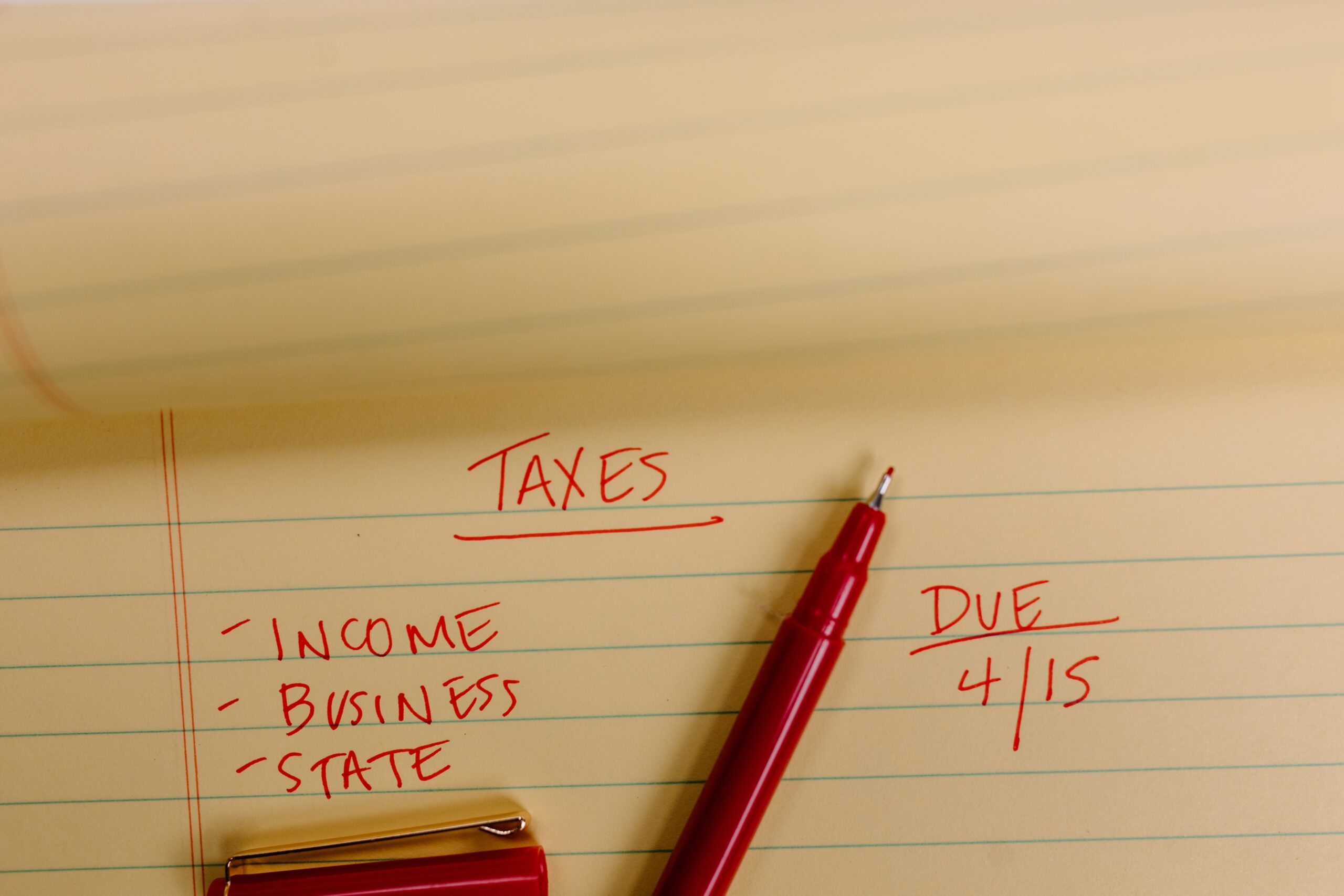

- January 27, 2025 – Tax season officially begins and IRS filing tools like Free File and Direct File become available

- April 15, 2025 – Deadline to file your federal tax return*

- NOTE: If you were affected by the California wildfires, you could be eligible for a deadline extension

- Free tax filing options – The IRS offers free online and in-person tax preparation options for eligible taxpayers through IRS Free File, IRS Direct File and Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs. For military members and some veterans, MilTax generally offers free return preparation and electronic filing software for federal income tax returns and up to three state income tax returns.

Refund anticipation loans (RALs) offer faster access to your tax refund, but they can come with hidden costs and risks. Consider these financial implications first.

Tax season often brings a sense of stress and frustration. However, there’s some good news on the horizon this year: the expansion of IRS Direct File.

In this video, we’ll break down the differences between the IRS Direct File tool and other free filing options.

Planning to enroll in health insurance sold through the Affordable Care Act Health Insurance Marketplace? The Premium Tax Credit (PTC) could affect your enrollment.

The EITC is a benefit for working people with low to moderate income. If you’re eligible, you may receive thousands of dollars depending on certain criteria like your income, filing status, and dependents. Find out if you’re eligible to claim this tax credit.

Waiting for a tax refund can be frustrating. Did you know there are things you can do to help speed up the process? Read More >

We all want accurate tax preparation, reasonable prices, and good service. But with so many options available, it can be difficult to choose. So let’s go over some tips. Read More >

Our tax code is complicated, but only a small portion applies to most of us. In this article, we’ll help you understand when you can file taxes yourself online and when you need to get help from a professional. Read More >

The IRS sends many types of letters. Some IRS letters don’t require any action on your part while other letters do require action and have deadlines. Find out what you need to do when you receive an IRS letter.Read More >

5 DIY Tips for filing your taxes online ➜

What Should I do with an IRS Letter? ➜

How to fix your tax return after making a tax filing mistake ➜

The 4 Most Common Tax Errors You Should Watch Out For ➜

Once you started a small business or become a gig worker, taxes can become more complicated. The learning curve can be steep, but these tips will help you avoid the most common mistakes.

When you’re juggling a full-time job and launching your small business, taxes become more difficult. These 7 tips will help you navigate filing your taxes when you add a 1099 to the mix. Read More >

Is it possible you could be writing off more as a small business owner or gig worker? These 5 often overlooked write-offs may surprise you. Read More >

Creating a small business can be overwhelming, but we’re here to help! We’ve curated a list of small business resources covering topics like financing, human resources, planning and operations, taxes, and more. Read More >

Whether you’re starting a small business or trying to grow one you’ve already built, you may need outside funding. The prospect of applying for funding can be intimidating, but we’ve got you! The first step is simply preparing all your documents and records.Read More >

You Could Quality for FREE Tax Filing Help

Tax Time Allies connects you with IRS-certified volunteers who provide free help with basic income tax return preparation to qualified individuals through the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs.

GetYourRefund.org provides free tax prep services to families earning less than $66,000 a year. Trained, IRS-certified volunteers will help you prepare and double-check your tax return before filing. These volunteers can also help you file for previous years and make sure you receive tax credits you qualify for.

Stay Alert for Fraud & Scams During Tax Time

Many people receive a lot of money in their tax refund. Unfortunately, scammers know this and often try to take advantage of people during this time. It’s important to be vigilant and know what to expect during tax time so you stay one step ahead.

Be extremely careful about what you share on social media related to your taxes, and make sure you’re going to official sources like the IRS website to get information.

Avoid tax scams and overcome identity theft this tax season ➜

Already Filed? Check the Status of Your Refund

Check the status of your refund using Where’s My Refund and the IRS2go app.

NO PURCHASE NECESSARY TO ENTER OR WIN. A PURCHASE WILL NOT INCREASE YOUR CHANCES OF WINNING. Open to legal residents of the 50 US/DC, 18 years of age and older. Entrant must use (or have used) their full legal name when creating the SaverLife account. Limit of one (1) SaverLife account per person. Void where prohibited. Promotion begins at 12:00 a.m. PT on 2/10/25 and ends at 11:59:59 p.m. PT on 4/27/25. For Official Rules, prize descriptions, odds disclosures, alternate methods of Sweepstakes entry, & all details, visit https://www.saverlife.org/official_rules/tax-time-2025. Sponsor: Earn Inc, dba SaverLife, 548 Market Street, PMB 46387, San Francisco, CA 94104.

SaverLife is a nonprofit organization dedicated to helping people improve their financial health. Through savings challenges, personalized tips, and trusted resources, we empower people to build stronger financial futures.