A Money-Saving Chart to Keep You Motivated

Do you need help saving money? Let’s go back to 2019, a year before COVID-19 hit. Maybe you’re excited about travel plans, graduation parties, or concerts coming up this year. All of a sudden, COVID-19 changes all of your plans. You might’ve lost your job, had to drop out of school, or help your family…

Read MoreWhich Credit Score Matters the Most?

Credit scores can be challenging to navigate. Financial jargon can be difficult to understand, but knowing what a credit score is and how they operate is a crucial part of building your financial future. A healthy credit score gives you access to credit cards, mortgages, and auto loans. Whether you’re preparing to apply for credit…

Read More2022 Tax Time Guide: Maximize Your Money at Tax Time

Looking for the 2024 Tax Time guide? Check out the new guide here. 2024 Tax Time Guide This tax season, we want to make sure you receive every dollar you deserve. That’s why we’re sharing tax filing resources that are 100% FREE for you. Browse our one-stop guide to master tax time and make it…

Read MoreA DC Saver Uses SaverLife to Reduce Debt and Build Savings

Meet Naomi, a nonprofit employee living in the Washington D.C. area and using SaverLife to save. Naomi didn’t learn much about money management when she was growing up. A few years ago, after surviving serious medical issues and parting ways with her husband, she decided to take control of her finances. Naomi’s goal this year…

Read MoreCelebrating 500,000 SaverLife Members: Our Chief Impact Officer’s Letter to You

When I joined SaverLife in 2017, we had 30,000 members. When our CEO, Leigh, told me that her goal was to reach 1 million members by 2022, I felt hesitant. Can SaverLife really reach one million people? Four years later, we’re well on our way. This month, we are celebrating the huge milestone of reaching…

Read MoreMaking Fee-Free Financial Services Available to Everyone

The California Public Banking Option Act, or BankCal, is an initiative to establish a public bank in California with basic consumer banking services, such as checking and savings. The bill builds upon programs such as CalSavers and CalKids, which aim to address the racial wealth gap in the state, by helping all Californians have access…

Read MoreHere’s How You Can Block an Eviction

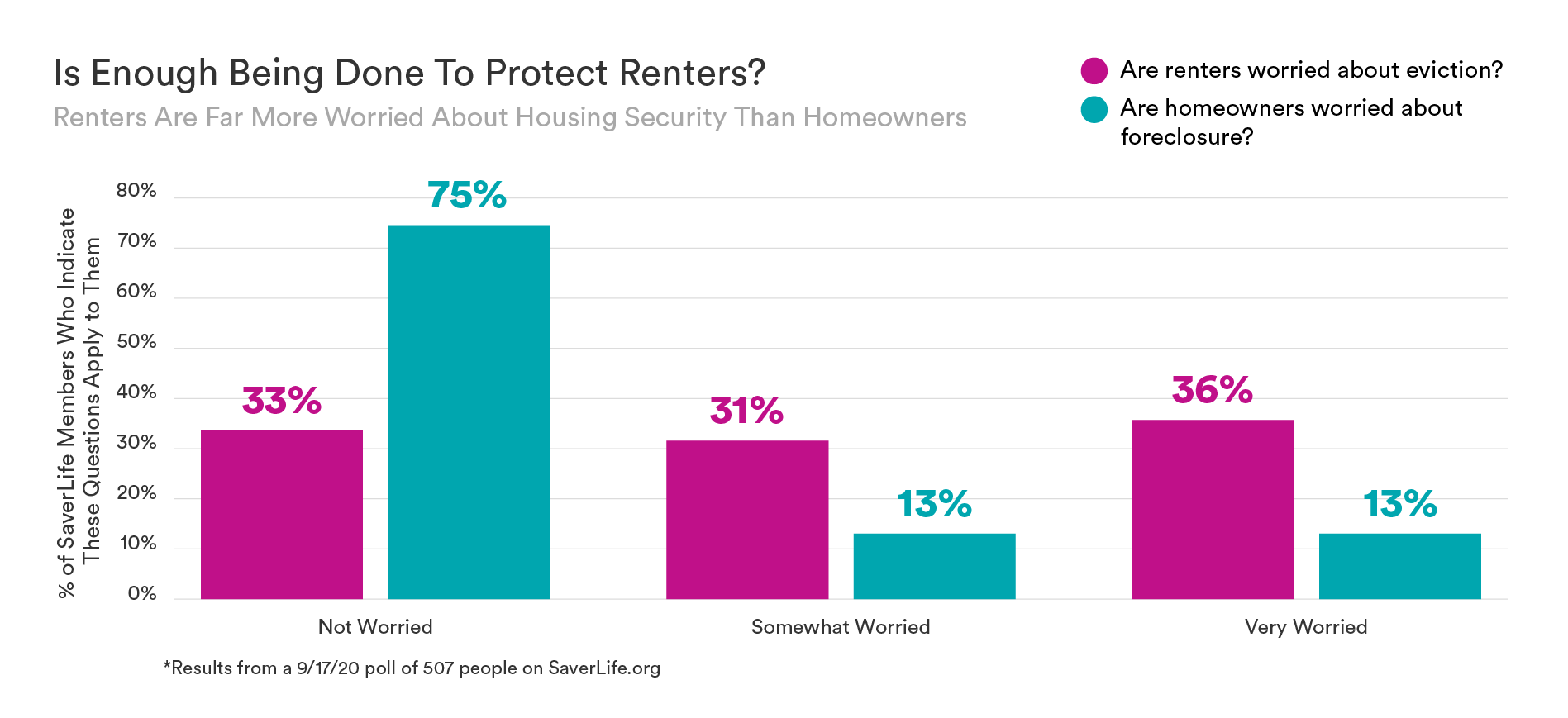

In response to housing insecurity potentially leading to an increase in COVID-19 cases, the CDC issued a nationwide temporary halt in evictions through June 30, 2021. In mid-September 2020, we asked over 500 members if they thought enough was being done to protect people from eviction or foreclosure. We found a large difference between the…

Read MoreA Tax Update on Third Stimulus and Unemployment: Your Questions Answered

We know that many of you have burning questions about unemployment benefits and the American Rescue Plan, including how they affect taxes and what is the relationship between the third stimulus and unemployment benefits. Here are answers to some of the questions you’ve asked about the third stimulus, unemployment extension, and their tax implications. How…

Read MoreLatest SaverLife Research: How Work, School, and Parenting Are Impacting Low-Income Parents

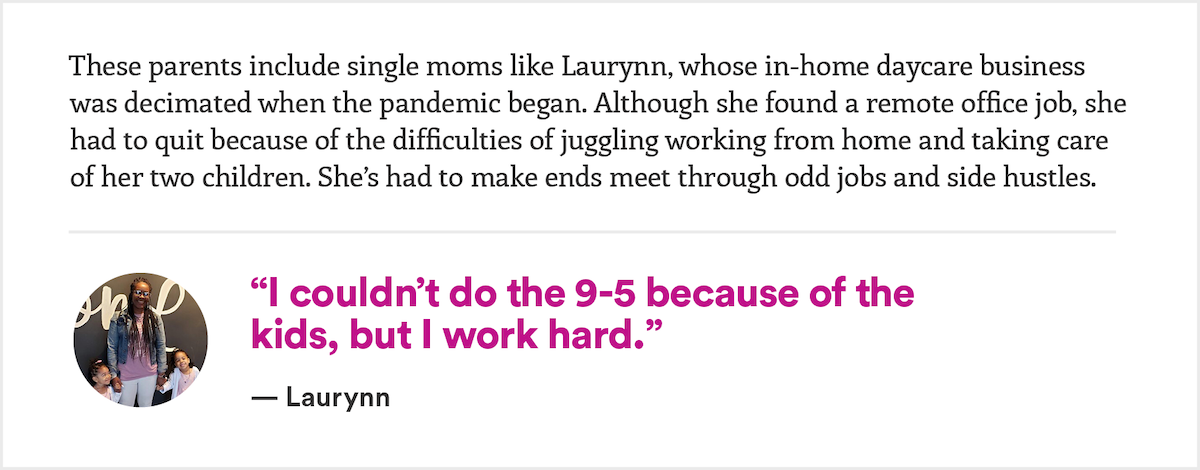

Parents of remote-schooled children are earning less money and facing increased expenses while being forced to make impossible choices between work and family. Low-income families were battling poverty and inequality, and the COVID-19 pandemic has only made things worse. Now is the time to start redesigning the way we systematically address opportunity and mobility in…

Read MoreTexas and Oklahoma: Three Reasons to File Taxes Soon, Even Though the IRS Deadline is Now June 15

Dear Texas and Oklahoma members, We know you’re out of the worst of the storm now, and we also know the damage that remains is real. We want to share some resources where you can get help if you need it: 211.org for help with bills Red Cross for family assistance You may have heard…

Read More