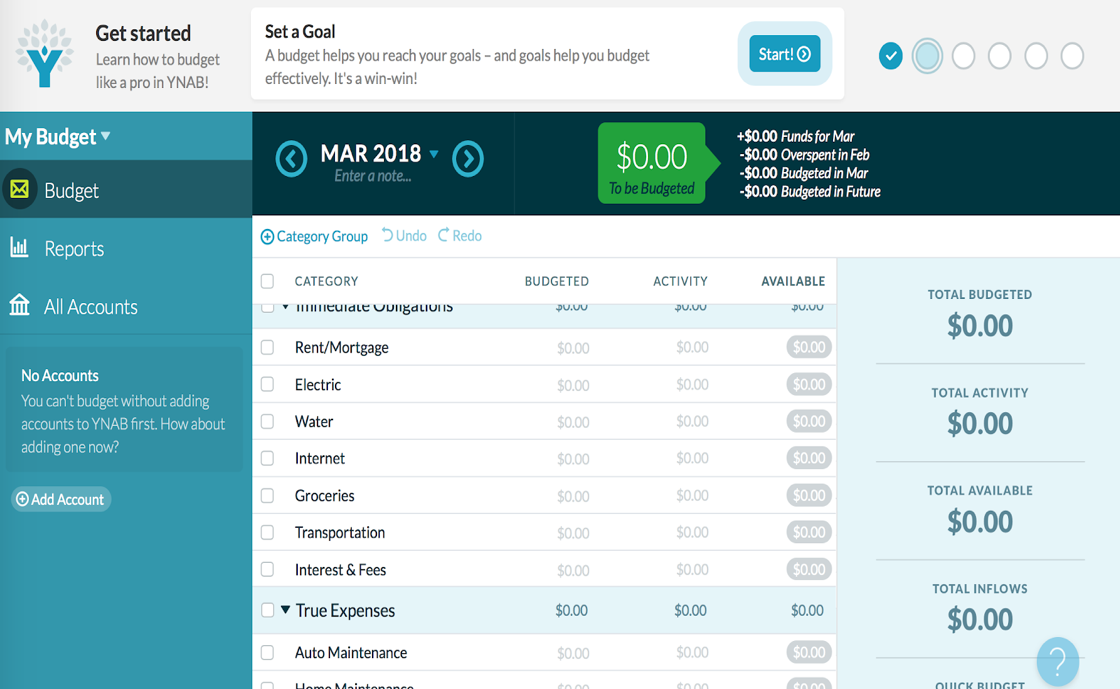

What apps do you recommend to track your spending habits?

This is the interface of You Need a Budget, one of the budgeting apps I’m trying out currently. What free or low-cost software/apps do you recommend to track your spending habits? There are so many out there to choose from and some are overly complicated and others require too much work. Submitted by Brittany.…

Read MoreSaverLife’s Top 5 Tips for Saving Money

We’ve heard so much great feedback from the SaverLife Community on money hacks they use to stretch their dollars and meet their savings goals. Let’s take a look at some of the top money-saving strategies that Savers have shared: 1. Negotiating with Bill Companies “For our medical bills, we got payments reduced by hospital and…

Read MoreHow can I manage money with a partner who has different money habits?

Do you have any advice for managing money and budgets with a partner who has a different view of spending and saving than I do? Submitted by anonymous. Ah, love and money! This can be blissful or stressful. For many people, money can make or break your relationship. It is pretty common to partner with…

Read MoreHow to Save Money Every Day

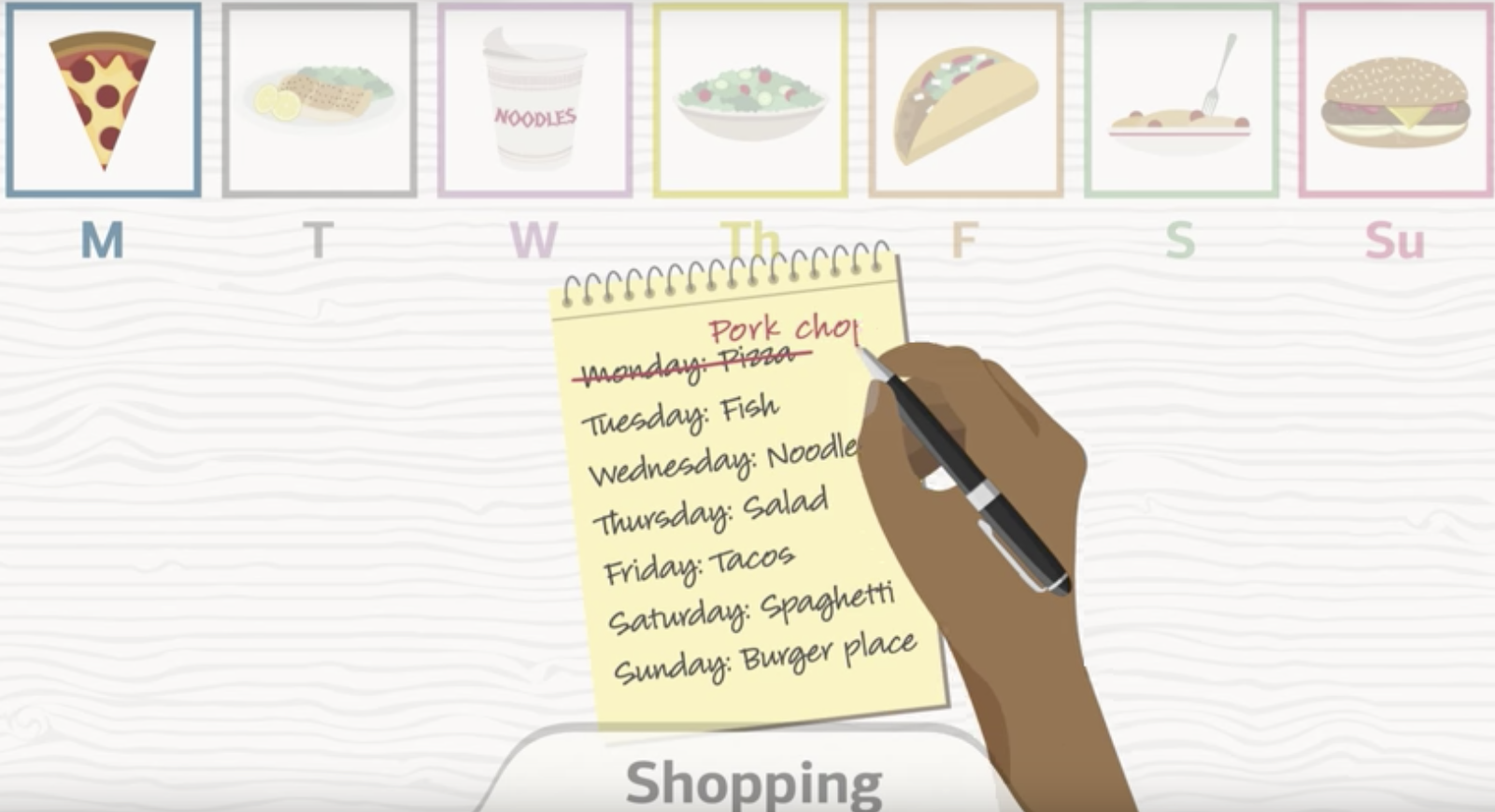

Making simple changes to your spending can be an easy way to help you start saving. Learn how to save money on everyday expenses like groceries, transportation and entertainment. This video will show you easy changes to make so you can start saving. Here are some of the fun ideas suggested in this video: Make…

Read MoreCut Your Expenses with a Savings Scavenger Hunt!

If you review your spending over the last month, you can almost certainly find one regular expense you can reduce. Then you can put the money toward savings instead. Grab a snack, put on some good music, and get your bank and credit card statements from last month (go ahead, we’ll wait)… Okay, scan through…

Read MoreGet an A+ on Back-to-School Savings

Ready to fill this year’s backpack with all new school supplies? Check out how much the average American spends on back-to-school and get an A+ on your spending by following these easy savings tips from Mint.com! SaverLifeSaverLife is a nonprofit organization dedicated to helping people improve their financial health. Through savings challenges, personalized tips,…

Read More5 Things to Keep in Mind When Selecting a Savings Account

A savings account is one of the simplest bank accounts you can get. Nearly all U.S banks and credit unions offer savings accounts. It’s worth it to shop around because accounts have varying fees, minimum balances, and interest rates. Keep the following things in mind when selecting an account. FDIC Deposit Insurance You should only…

Read More6 Easy Steps to Set a Budget that You’ll Actually Stick To

Whether it’s something you need or something you want, creating a budget can help you keep your spending in line so you can reach your financial goals. Creating a budget may seem daunting, but this video walks you through setting up a budget that you can actually stick to. Once you know what your goal…

Read MoreAre You On Track? Reevaluating Your Financial Priorities

Crash Course in Financial Flexibility Our lives are complex, and that’s usually a good thing because it keeps life interesting. But when it comes to our money, the more complex our situation, the more challenging it is to manage competing priorities. What’s the Opportunity Cost? We suspect you have more than one thing you want…

Read MoreWhat is Money Mindfulness?

What Do You Believe? Everything you DO with money makes perfect sense if you know what you BELIEVE about money. If you believe that money is a necessary evil, you may resist saving. If you believe there will never be enough money, you may be reluctant to spend it. Our money fears and fantasies set…

Read More