The 3 Most Common Tax Myths

Our Federal tax code is complicated. One thing this causes is misunderstandings of tax law. I like to call these misunderstandings “tax myths.” Like many myths, tax myths often have some truth in them. Let’s look at three common tax myths. 1. I Don’t Want to Go Up to a New Tax Bracket Sometimes people…

Read MoreWhat Is the Recovery Rebate Credit?

The COVID 19 pandemic has impacted our lives quite a bit. It has even changed our tax forms by adding a tax credit. The Recovery Rebate Credit was authorized by the CARES Act. Many of us received all or part of it in advance in the form of an Economic Impact Payment. And the Consolidated…

Read MoreYou Can Probably File Your Taxes for Free. Really.

Sign up for SaverLife to take the Tax Time Pledge and enter to win cash prizes. We know taxes are important. The government needs revenue to do things it does for our society. We want to comply with the law and pay the taxes we owe. Plus, most of us want a refund if we…

Read MoreThe Saver’s Credit: Are You Double Dipping on Tax Savings?

How Do Tax-Advantaged Accounts Work? When you contribute to a retirement account like an Individual Retirement Arrangement (IRA) or a qualified employer-sponsored retirement plan (like a 401K), you receive a tax advantage. If the account is a traditional account, you may be able to reduce your taxable income for the current year. However, you’ll pay…

Read MoreI’m Married and Filed Jointly, Then the IRS Kept My Refund. What Happened?

Sometimes you don’t realize it is going to happen. You are expecting your tax refund and it never arrives. You may ask your tax professional or call the IRS at 1-800-829-1040. Here’s what may have happened: they kept the refund because your spouse owes money. This is often back taxes, both federal and state. But…

Read MoreIf I Can Pay off My Debt, Is it Better for My Credit to Pay it off Slowly or All at Once?

I think I’m going to receive a large tax refund this year that could help me pay off my debts. If I’m able to pay off all of my debt, should I do it all at once or is it better for my credit to pay it off slowly over time? Submitted by an anonymous…

Read MoreDoes the New $300 Cares Act Charitable Contribution Deduction Help Me With My Taxes?

Spoiler alert: Like many things in personal finance and taxes the answer is it depends. And even when it does help, it won’t be much help for most of us. First, some background on deducting charitable contributions. Before the CARES Act was passed this year (2020), taxpayers generally had one option to deduct charitable contributions.…

Read MoreCan I get a stimulus check without filing taxes?

The U.S. government has just started disbursing the stimulus checks it promised to millions of Americans. Questions still linger for many, including whether they need to submit new information in order to get that money. Will I get stimulus if I haven’t filed 2019 yet? The government will calculate the amount of money you receive…

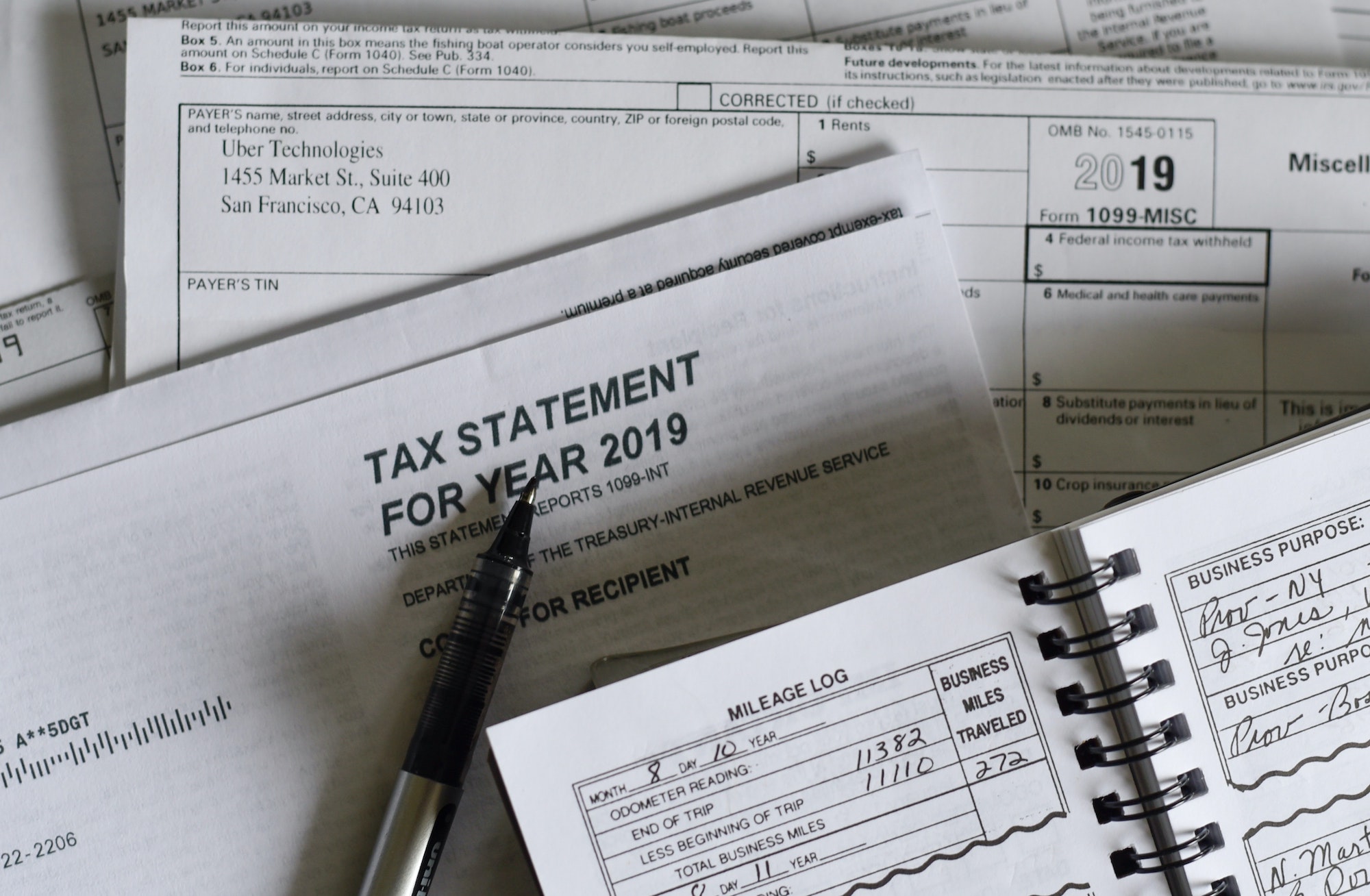

Read MoreGuide to Filing Taxes as an Independent Contractor

New to being an independent contractor? Here’s what you need to know about taxes. Being an independent contractor or gig worker comes with more flexibility. It also comes with new tax responsibilities. At a high level, the IRS considers you an independent contractor, and therefore self-employed. You are paid for the result of your work,…

Read MoreShould I itemize my deductions or take the standard deduction?

The goal of deductions is to lower the amount of taxable income the IRS will use when calculating the amount of tax you owe. The decision of whether to itemize your deductions or take the standard deduction comes down to one question. Which deduction is bigger and will lower your tax burden more? Currently, the…

Read More