What is a good interest rate?

You may have heard that there are only two kinds of people: those who pay interest and those who earn it. In reality, we all likely end up occupying both sides of that equation. The first thing to know about borrowing money and paying interest is that how much you pay depends on your credit…

Read MoreWhat is private mortgage insurance?

If you get a conventional loan and make a down payment of less than 20 percent of the home price, you are required to purchase private mortgage insurance (PMI). PMI protects the lender (not you) in case you fail to make your mortgage payments. Banks, savings associations, credit unions, and mortgage companies make conventional loans…

Read MoreHow should I pay off medical debt that’s been sent to a collection agency?

“My debt from an unpaid urgent care bill has been sent to a collection agency. What is the best way to go about paying off this debt?” Submitted by Jessica J. Medical debt is a huge financial stressors for many people. Taking action early is the best way to get it under control. Double-check your…

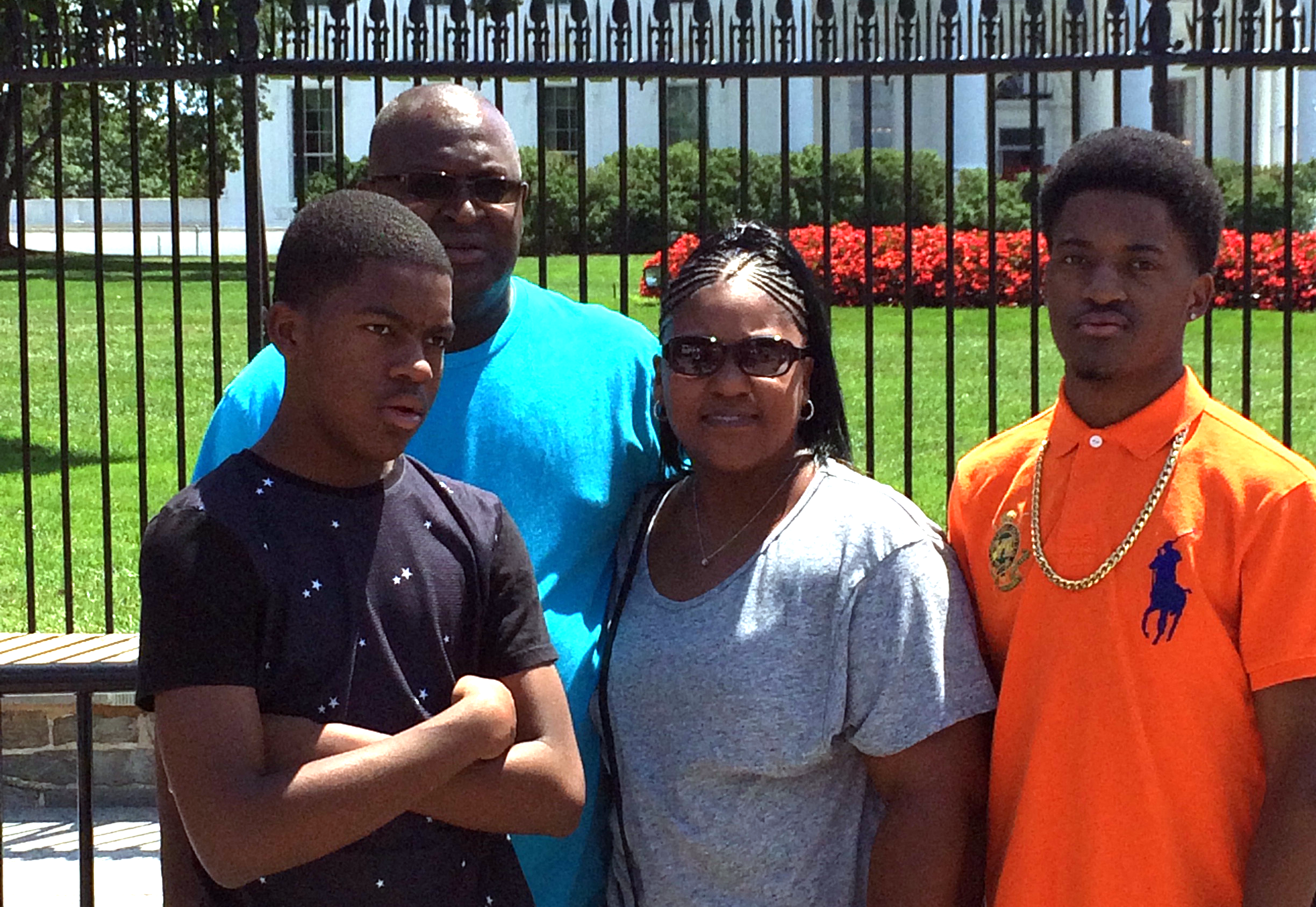

Read MoreSylvia’s Story: Home Ownership in the Future

Meet Sylvia, an HR Manager for the Clark County School District in Nevada. She’s a Las Vegas native who lives with her husband and two adult sons. What did your upbringing teach you about finances? Nothing! That’s why I’m in debt now. I don’t think I was ever taught how to save or how important…

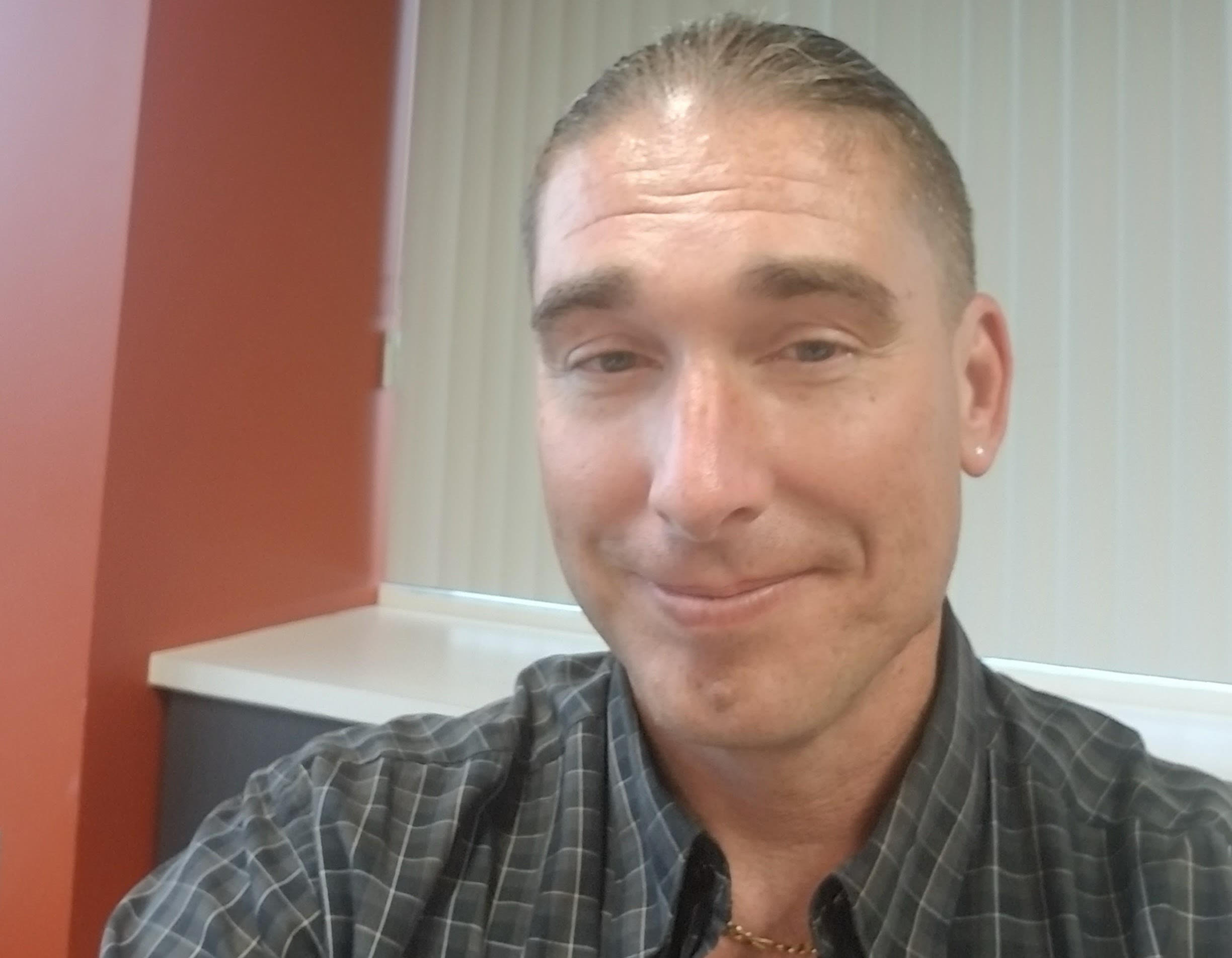

Read MoreMichael’s Story: Make Your Money Work For You

Meet Michael, a substance abuse counselor who lives in San Diego, California. What do you do? I’m a substance abuse counselor. I’ve been doing it for about two years now – midlife career change. Unfortunately, it’s one of the fastest growing professions in the US, which doesn’t bode well for us. What did your upbringing…

Read MoreDo you recommend credit consolidation?

Do you recommend credit consolidation to improve scores and decrease debt? Submitted by Natasha P. There are two parts to this question, so let’s dig into them separately. Improving Your Credit Score Whenever a financial institution pulls your credit with the purpose of offering you a loan, your score may be affected. Closing a credit…

Read MoreHow many credit cards should I have?

“Hi Saundra! As someone who is getting her credit back in order, I want to be wise about applying for credit cards. I have two and working hard to keep them both under 30% utilization. I’m considering applying for one last card. How many credit cards is too many?” Submitted by Laurin O. There are…

Read MoreWhat Does It Mean to Refinance a Mortgage?

Let’s start with the basics. Refinancing simply means that you’re replacing your existing loan with a new mortgage. Reasons for Refinancing a Mortgage If you’re considering refinancing, your reasons may include: A lower interest rate Shorter (or longer) term to pay off the loan or cash out equity Changing the type of mortgage (you may…

Read More2018: Thank you for a wonderful year!

Happy holidays from all of us at SaverLife! 2018 has been a big year for us. We’ve been busy creating new ways to reward you for saving and learning more about what actually helps people save. Here are just a few highlights from 2018: You won prizes for saving every week In 2018, we launched…

Read MoreHow do you balance debt and savings? Here’s what our research found.

If you’re paying down debt, saving money may be a low priority for you. After all, you’re probably paying interest on your debt every month, so paying off your debt more quickly means keeping more money in your pocket long-term. It’s harder to save when you have debt Our research found that Savers with a…

Read More